UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

CLARUS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CLARUS CORPORATION

2084 East 3900 South

Salt Lake City, UT 84124

April 26, 2022

To Our Stockholders:

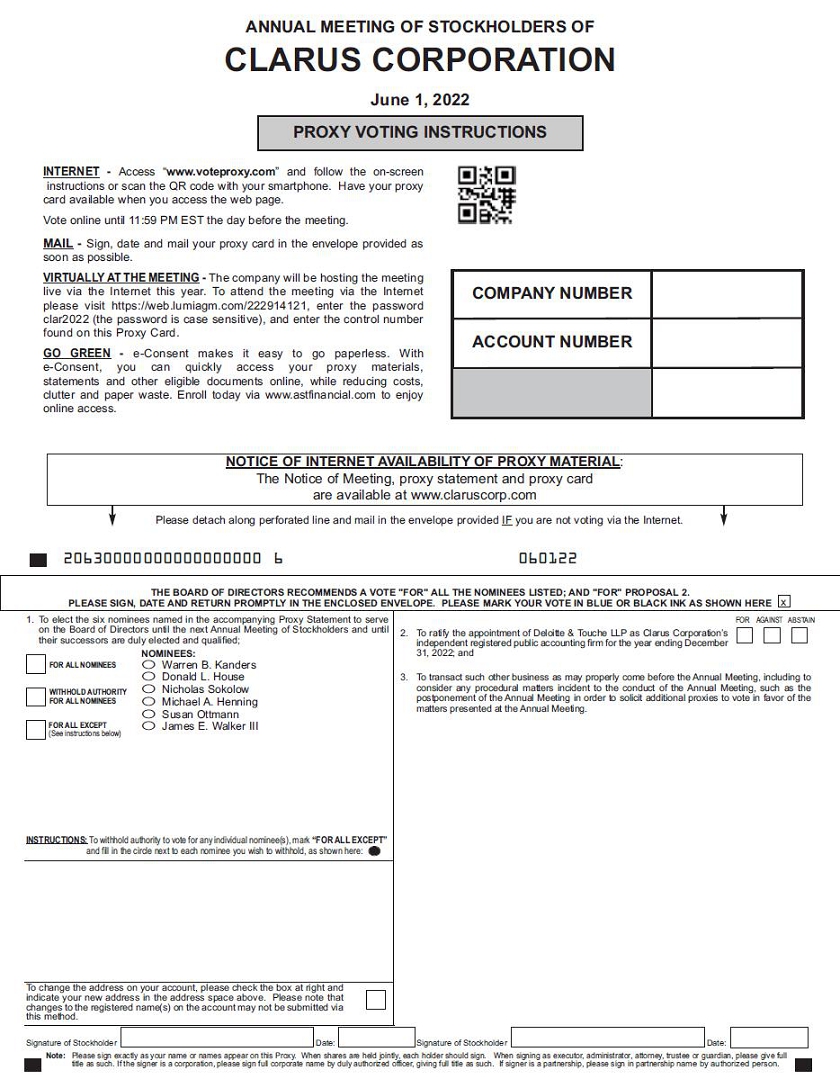

On behalf of the Board of Directors of Clarus Corporation, I cordially invite you to participate in the Annual Meeting of Stockholders to be held on June 1, 2022, at 10:00 a.m., Eastern Time. The annual meeting will be a virtual meeting of stockholders, which will be conducted in a virtual-only meeting format via live webcast. Information on how to participate in this year’s annual meeting can be found on page 39. Stockholders will NOT be able to attend the Annual Meeting in-person.

The accompanying Notice of Meeting and Proxy Statement cover the details of the matters to be presented.

The Proxy Statement and form of proxy card, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, are available at www.claruscorp.com.

REGARDLESS OF WHETHER YOU PLAN TO PARTICIPATE IN THE ANNUAL MEETING VIRTUALLY, I URGE YOU TO VOTE BY RETURNING YOUR COMPLETED PROXY CARD OR VOTING VIA THE INTERNET AS described in THIS Proxy Statement and THE proxy card AS SOON AS POSSIBLE. YOUR VOTE IS IMPORTANT AND WILL BE GREATLY APPRECIATED. RETURNING YOUR COMPLETED PROXY CARD OR VOTING VIA THE INTERNET AS described in THIS Proxy Statement and THE proxy card WILL ENSURE THAT YOUR VOTE IS COUNTED IF YOU LATER DECIDE NOT TO PARTICIPATE IN THE ANNUAL MEETING VIRTUALLY.

| Cordially, | |

| CLARUS CORPORATION | |

| Warren B. Kanders | |

| Executive Chairman of the | |

| Board of Directors |

CLARUS CORPORATION

Notice of Annual Meeting of Stockholders

To Be Held on June 1, 2022

To Our Stockholders:

You are cordially invited to participate in the Annual Meeting of Stockholders, and any adjournments or postponements thereof (the “Meeting”), of Clarus Corporation (the “Company” or “Clarus”), which will be held on June 1, 2022, at 10:00 a.m., Eastern Time, in a virtual-only meeting format via live webcast, for the following purposes:

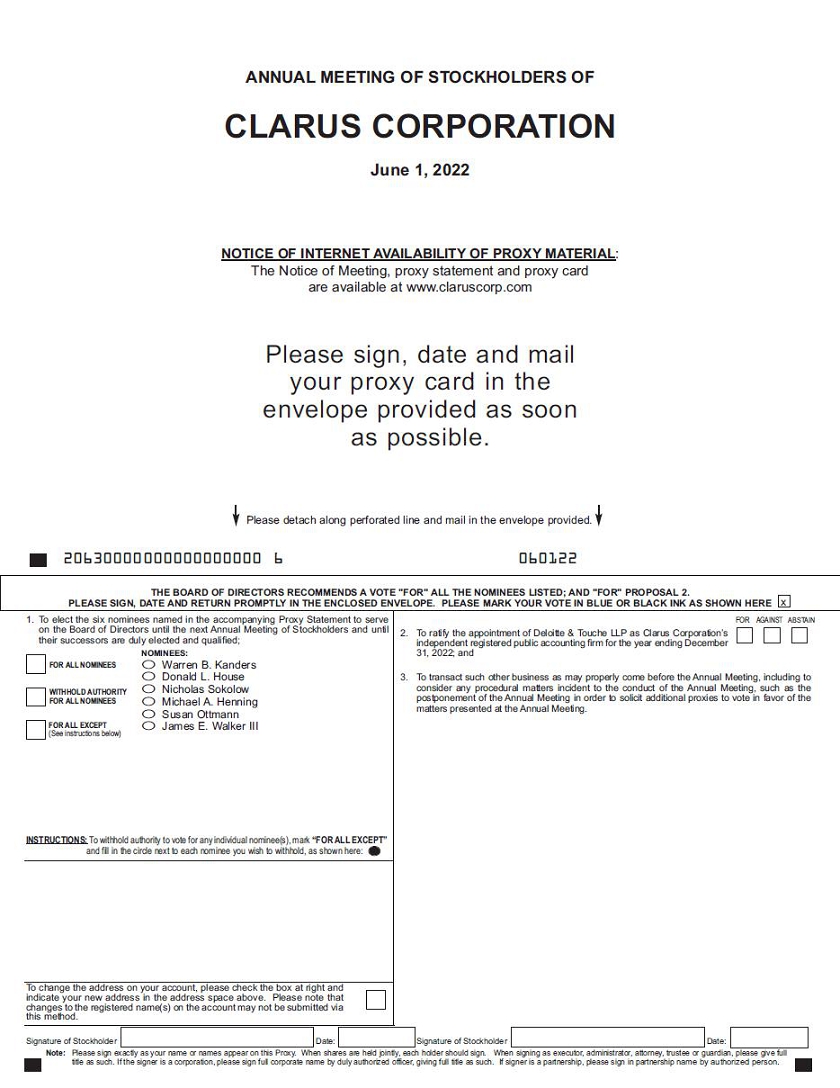

1. To elect the six nominees named in the accompanying Proxy Statement to serve on the Board of Directors until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified (Proposal 1);

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 (Proposal 2); and

3. To transact such other business as may properly come before the Meeting, including to consider any procedural matters incident to the conduct of the Meeting, such as the postponement of the Meeting in order to solicit additional proxies to vote in favor of the matters presented at the Meeting.

Stockholders of record at the close of business on April 18, 2022, are entitled to notice of and to vote at the Meeting.

Due to the continued public health concerns relating to the COVID-19 pandemic and our concerns about protecting the health and well-being of our stockholders and employees, the Board of Directors has determined to convene and conduct the Meeting, in a virtual-only meeting format via live webcast at https://web.lumiagm.com/ 222914121. Stockholders will NOT be able to attend the annual meeting in-person. Information on how to participate in this year’s virtual-only meeting can be found on page 39.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to Be Held on June 1, 2022: This Proxy Statement and form of proxy card, along with our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, are available at www.claruscorp.com.

YOUR VOTE IS IMPORTANT. PLEASE SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE OR VOTE VIA THE INTERNET AS described in THIS Proxy Statement and THE proxy card, TO ENSURE THAT YOUR VOTE IS COUNTED.

| By Order of the Board of Directors | |

| Aaron J. Kuehne | |

| Secretary | |

| April 26, 2022 |

CLARUS CORPORATION

2084 East 3900 South

Salt Lake City, UT 84124

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

JUNE 1, 2022

INTRODUCTION

Proxy Solicitation and General Information

This Proxy Statement and the enclosed form of proxy card (the “Proxy Card”) are being furnished to the holders of common stock, par value $0.0001 per share, of Clarus Corporation, a Delaware corporation (which is sometimes referred to in this Proxy Statement as “Clarus,” the “Company,” “we,” “our” or “us”), in connection with the solicitation of proxies by our Board of Directors for use at the Annual Meeting of Stockholders to be held on June 1, 2022, at 10:00 a.m., Eastern Time, and at any adjournments or postponements thereof (the “Meeting”). The Meeting will be a virtual-only meeting of stockholders, which will be conducted via live webcast. Information on how to participate in this year’s Meeting can be found on page 39. This Proxy Statement and the Proxy Card are first being sent to stockholders on or about May 3, 2022.

At the Meeting, stockholders will be asked:

1. To elect the six nominees named in this Proxy Statement to serve on the Board of Directors until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified (Proposal 1);

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 (Proposal 2); and

3. To transact such other business as may properly come before the Meeting, including to consider any procedural matters incident to the conduct of the Meeting, such as the postponement of the Meeting in order to solicit additional proxies to vote in favor of the matters presented at the Meeting.

The Board of Directors has fixed the close of business on April 18, 2022, as the record date for the determination of stockholders entitled to notice of and to vote for the matters presented at the Meeting. Each such stockholder will be entitled to one vote for each share of common stock held on all matters to come before the Meeting and may vote by (a) visiting the Internet site listed on the Proxy Card, or (b) submitting your Proxy Card by mail by using the provided self-addressed, stamped envelope. Voting via the Internet or submitting a Proxy Card will not prevent you from voting virtually at the Meeting, but it will help to secure a quorum and avoid added solicitation costs.

Proxies and Voting

Whether or not you expect to participate in the virtual-only Meeting, the Board of Directors urges stockholders to submit a proxy to vote your shares in advance of the meeting by (a) visiting https://web.lumiagm.com/222914121 and following the on screen instructions (have your proxy card when you access the webpage), or (b) submitting your Proxy Card by mail by using the previously provided self-addressed, stamped envelope. Submitting a proxy to vote your shares will not prevent you from revoking a previously submitted proxy or changing your vote as described below.

Unless revoked, a proxy will be voted at the virtual-only Meeting in accordance with the stockholder’s indicated instructions. In the absence of instructions, the shares will be voted FOR the election of each nominee for director named in this Proxy Statement (Proposal 1); and FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal 2).

Voting

Most beneficial owners whose stock is held in street name do not receive the Proxy Card. Instead, they receive voting instruction forms or proxy ballots from their bank, broker or other agent. Beneficial owners should follow the instructions on the voter instruction form or proxy ballot they receive from their bank, broker or other agent.

Our Board of Directors has selected each of Warren B. Kanders and Nicholas Sokolow to serve as “Proxyholders” for the Meeting.

Revocation of Proxy

A stockholder who so desires may change or revoke its previously submitted vote at any time before the Meeting by: (i) delivering written notice to us at Clarus Corporation, 2084 East 3900 South, Salt Lake City, UT 84124, c/o Aaron J. Kuehne, Executive Vice President, Chief Operating Officer, Secretary and Treasurer; (ii) duly executing and delivering a Proxy Card bearing a later date; or (iii) by voting again by Internet voting options described in this Proxy Statement and the Proxy Card. If your shares are held in “street name” through a bank, broker or other nominee, any changes need to be made through them. Your last vote will be the vote that is counted. Unless revoked, a proxy will be voted at the virtual-only Meeting in accordance with the stockholder’s indicated instructions. Participation in the virtual-only Meeting will not in and of itself constitute a revocation of a proxy.

Voting on Other Matters

The Board of Directors knows of no other matters that are to be brought before the Meeting other than as set forth in the Notice of Meeting. If any other matters properly come before the Meeting, the persons named in the enclosed Proxy Card or their substitutes will vote in accordance with their best judgment on such matters.

Record Date; Shares Outstanding and Entitled to Vote

Only stockholders as of the close of business on April 18, 2022 (the “Record Date”) are entitled to notice of and to vote at the Meeting. As of the Record Date, there were 37,224,109 shares of our common stock outstanding and entitled to vote, with each share entitled to one vote. See “Beneficial Ownership of Company Common Stock By Directors, Officers and Principal Stockholders” for information regarding the beneficial ownership of our common stock by our current directors, executive officers and stockholders known to us to beneficially own five percent (5%) or more of our common stock.

Quorum; Required Votes

The presence, virtually or by duly authorized proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote constitutes a quorum for this Meeting.

Abstentions and “broker non-votes” are counted as present for purposes of determining whether a quorum exists. A “broker non-vote” occurs when a nominee such as a bank, broker or other agent holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

Under the rules of various national and regional securities exchanges, nominees have such discretion to vote absent instructions with respect to certain “routine” matters, such as Proposal 2, the ratification of independent auditors, but not with respect to matters that are considered “non-routine,” such as the election of directors. Accordingly, without voting instructions from you, your broker will not be able to vote your shares on Proposal 1, which is a non-routine matter.

2

Each share of Clarus’ common stock entitles the holder to one vote on each matter presented for stockholder action. The affirmative vote of a plurality of the votes cast virtually at the Meeting or represented by proxy at the Meeting is necessary for the election of the six nominees named in this Proxy Statement (Proposal 1). The affirmative vote of a majority of the shares of common stock present virtually at the Meeting or represented by proxy at the Meeting is necessary for the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 (Proposal 2).

Since the affirmative vote of a plurality of votes cast virtually at the Meeting or represented by proxy at the Meeting is required for Proposal 1, abstentions and “broker non-votes” will have no effect on the outcome of such election. Since the affirmative vote of a majority of the shares of common stock present virtually at the Meeting or represented by proxy at the Meeting is necessary for the approval of Proposal 2, abstentions will have the same effect as a negative vote, but “broker non-votes” will have no effect on the outcome of the voting for Proposal 2.

An inspector of elections appointed by us will tabulate votes at the Meeting.

Proxy Solicitation; Expenses

Clarus will bear the costs of the solicitation of proxies for the Meeting. Our directors, officers and employees may solicit proxies from stockholders by mail, telephone, telegram, e-mail, personal interview or otherwise. Such directors, officers and employees will not receive additional compensation but may be reimbursed for out-of-pocket expenses in connection with such solicitation. Brokers, nominees, fiduciaries and other custodians have been requested to forward soliciting material to the beneficial owners of our common stock held of record by them and such parties will be reimbursed for their reasonable expenses.

List of Stockholders

In accordance with the Delaware General Corporation Law (the “DGCL”), a list of stockholders entitled to vote at the Meeting will be available for ten days prior to the Meeting, for any purpose germane to the Meeting, between the hours of 10:00 a.m. and 5:00 p.m., local time, at our offices at 2084 East 3900 South, Salt Lake City, UT 84124.

Voting Confidentiality

Proxy Cards, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed to unrelated third parties except as required by law.

Appraisal Rights

Stockholders will have no rights of appraisal under the DGCL in connection with the proposals to be considered at the Meeting.

IT IS DESIRABLE THAT AS LARGE A PROPORTION AS POSSIBLE OF THE STOCKHOLDERS’ INTERESTS BE REPRESENTED AT THE MEETING. THEREFORE, EVEN IF YOU INTEND TO BE PRESENT VIRTUALLY AT THE MEETING, PLEASE COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD OR VOTE VIA THE INTERNET AS described in THIS Proxy Statement and THE proxy card TO ENSURE THAT YOUR STOCK WILL BE REPRESENTED. YOUR ParticipatiION in the Virtual-only meeting will not in and of itself constitute a revocation of YOUR PRIOR VOTE.

3

BENEFICIAL OWNERSHIP OF COMPANY COMMON STOCK BY

DIRECTORS, OFFICERS AND PRINCIPAL STOCKHOLDERS

The following table sets forth, as of April 18, 2022, certain information regarding the beneficial ownership of the common stock outstanding by (i) each person known to us to own or control five percent (5%) or more of our common stock, (ii) each of our current directors and nominees, (iii) each of our current “Named Executive Officers” (as defined in Item 402(a)(3) of Regulation S-K) set forth in the summary compensation table on page 23 and (iv) our current Named Executive Officers and directors and nominees as a group. Unless otherwise indicated, each person named in the table below has sole voting and investment power with respect to the shares beneficially owned. Unless otherwise indicated, the address of each person named in the table below is c/o Clarus Corporation, 2084 East 3900 South, Salt Lake City, UT 84124.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days.

The beneficial ownership percentages set forth in the table below are based on approximately 37,224,109 shares of common stock issued and outstanding as of April 18, 2022.

In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of April 18, 2022, shares of common stock subject to warrants and shares of restricted stock that vest within 60 days of April 18, 2022. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

Unless otherwise noted in the footnotes to the following table, and subject to applicable community property laws, the persons and entities named in the table have sole voting and investment power with respect to their beneficially owned common stock.

4

| Name | Common Stock Beneficially Owned (1) | Percentage (%) of Common Stock (2) | ||||||

Five Percent Holders: | ||||||||

| TT Investimentos Ltda | 3,453,512 | (3) | 9.3 | |||||

| Brown Advisory Incorporated | 3,098,941 | (4) | 8.3 | |||||

| Greenhouse Funds LLLP | 2,606,621 | (5) | 7.0 | |||||

| Cropley Nominees Pty Ltd | 2,315,121 | (6) | 6.2 | |||||

Directors and Named Executive Officers: | ||||||||

| Warren B. Kanders | 6,551,235 | (7) | 17.3 | |||||

| Nicholas Sokolow | 780,527 | (8) | 2.1 | |||||

| Donald L. House | 430,000 | (9) | 1.1 | |||||

| Michael A. Henning | 235,000 | (10) | * | |||||

| Susan Ottmann | 15,000 | (11) | * | |||||

| James E. Walker III | 0 | * | ||||||

| John C. Walbrecht | 701,840 | (12) | 1.9 | |||||

| Aaron J. Kuehne | 853,656 | (13) | 2.2 | |||||

| Michael J. Yates | 0 | (14) | * | |||||

| All current directors, nominees and named executive officers as a group (9 persons) | 9,567,258 | (15) | 24.1 | |||||

* Denotes less than one percent.

| (1) | As used in this table, a beneficial owner of a security includes any person who, directly or indirectly, through contract, arrangement, understanding, relationship or otherwise has or shares within 60 days of April 18, 2022, (a) the power to vote, or direct the voting of, such security or (b) investment power which includes the power to dispose, or to direct the disposition of, such security. |

| (2) | Applicable percentage of beneficial ownership is based on 37,224,109 shares of our common stock outstanding as of April 18, 2022. |

| (3) | Based solely on a Schedule 13G filed with the SEC on October 27, 2021 filed on behalf of TT Investimentos Ltda, a Brazilian sociedad limitada (“TT Investimentos”), TT Global Equities, a fund duly registered in the Cayman Islands, and a Cayman Islands entity (“TT Global Equities”), Rocinante Fund, a fund duly registered in the Cayman Islands, and a Cayman Islands entity, (“Rocinante Fund”), and Mr. Antonio Fraga Baer Bahia, the principal of TT Investimentos. In such filing, TT Investimentos and Antonio Fraga Baer Bahía list their respective address as Av General San Matin 1002 Sl 301b, Lebon, Rio de Jainero, RJ, Brazil, and indicate that, as of October 27, 2021, TT Investimentos as the investment advisor to the accounts of certain private funds and managed accounts (collectively, the “TT Investimentos Accounts”) may direct the vote and disposition of the 3,453,512 shares of common stock held by the TT Investimentos Accounts, as well as of TT Global Equities and the Rocinante Fund. Antonio Fraga Baer Bahía, as the principal of TT Investimentos, may direct the vote and disposition of the 3,453,512 shares of common stock held by the TT Investimentos Accounts. |

| (4) | Based solely on a Schedule 13G filed with the SEC on February 4, 2022, by Brown Advisory Incorporated on its own behalf and on behalf of certain of its subsidiaries. In such filing, Brown Advisory Incorporated and its subsidiaries list their address as 901 South Bond Street, Suite 400, Baltimore, MD 21231, and indicate that, as of December 31, 2021, Brown Advisory Incorporated and its subsidiaries had sole voting power with respect to 2,683,378 shares of common stock, and that Brown Advisory Incorporated and its subsidiaries did not have shared voting power or sole dispositive power with respect to any shares of common stock and had shared dispositive power with respect to 3,098,941 shares of common stock. |

| (5) |

Based solely on a Schedule 13G filed with the SEC on February 14, 2022 by Greenhouse Funds LLLP, Greenhouse GP LLC and Joseph Milano (collectively, the “Greenhouse Parties”). In such filing, the Greenhouse Parties list their address as 650 S. Exeter St., Suite 1080, Baltimore, MD 21202, and indicate that, as of December 31, 2021, they did not have sole voting or dispositive power with respect to any shares of common stock and had shared voting and dispositive power with respect to 2,606,621 shares of common stock. Each of Greenhouse GP LLC and Joseph Milano has beneficial ownership of the shares held by Greenhouse Funds LLLP by virtue of their respective roles as a control person of Greenhouse Funds LLLP. |

5

|

(6)

|

Based solely on a Schedule 13G filed with the SEC on July 12, 2021 by Cropley Nominees Pty Ltd, Cropley Family Trust and Richard Oswald Cropley (the “Cropley Parties”). In such filing, Cropley Nominees Pty Ltd and Cropley Family Trust list their address as 22 Hanson Place Eastern Creek, NSW 2766, Australia and Mr. Cropley listed his address as 1 Government Road, Mosman, NSW 2088, Australia. As of July 1, 2021, the Cropley Parties had shared voting and dispositive power with respect to 2,315,121 shares of common stock. Richard Oswald Cropley, the sole director of Cropley Nominees Pty Ltd, holds the voting and dispositive power with respect to the shares of common stock held by Cropley Nominees Pty Ltd, in its capacity as trustee of the Cropley Family Trust.

|

| (7) | Includes (i) Mr. Kanders’ options to purchase 635,333 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022; (ii) 2,028,464 shares of common stock held by Kanders GMP Holdings, LLC, of which Mr. Kanders is a majority member and a trustee of the manager; (iii) 10,851 shares of common stock that Mr. Kanders may be deemed to beneficially own as UTMA custodian for his children; (iv) 125,222 shares of common stock held by Mr. Kanders’ spouse in a UTA Trust Account of which Mr. Kanders is the sole trustee; (v) 8,916 shares of common stock that Mr. Kanders may be deemed to beneficially own as joint tenancy with rights of survivorship; and (vi) 100,444 shares of common stock that are beneficially owned by Mr. Kanders’ spouse. Of the 5,915,902 shares of common stock included in Mr. Kanders’ beneficial ownership, 4,840,971 shares are hypothecated and/or pledged as security for loans from financial institutions. Excludes (i) options to purchase 270,664 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022; (ii) stock award of 233,333 shares of restricted common stock granted on January 7, 2019 under the Company’s 2015 Stock Incentive Plan of which (A) 116,667 shares of the Company’s common stock shall vest on January 28, 2023; and (B) 116,666 shares of the Company’s common stock shall vest on January 28, 2024, (iii) a stock award of 500,000 shares of restricted common stock granted to Mr. Kanders on May 28, 2021 under the Company’s 2015 Stock Incentive Plan all of which shall vest if on or before May 28, 2024, the Fair Market Value (as defined in the 2015 Stock Incentive Plan) of the common stock shall have equaled or exceeded $35.00 per share for twenty consecutive trading days; and (iv) a stock award of 500,000 shares of restricted common stock granted to Mr. Kanders on May March 4, 2022 under the Company’s 2015 Stock Incentive Plan all of which shall vest if on or before March 4, 2032, the Fair Market Value (as defined in the 2015 Stock Incentive Plan) of the common stock shall have equaled or exceeded $50.00 per share for twenty consecutive trading days. The business address for Kanders GMP Holdings, LLC is 250 Royal Palm Way, Suite 201, Palm Beach, FL 33480. |

| (8) | Includes (i) Mr. Sokolow’s options to purchase 182,500 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022; (ii) 35,000 shares of common stock held by Korsak Holdings, LLC, a limited liability company of which Mr. Sokolow is the general manager; (iii) 379,244 shares of common stock held by ST Investors Fund, LLC, a limited liability company of which Mr. Sokolow is the general manager; and (iv) 83,293 shares of common stock held by Madetys Investments, LLC, a limited liability company of which Mr. Sokolow is the general manager. The business address for each of ST Investors, LLC, Korsak Holdings, LLC and Madetys Investments LLC is 6020 Shore Boulevard South, Suite 801, Gulfport, FL 33707. Mr. Sokolow disclaims beneficial ownership of the shares of common stock owned by each of ST Investors, LLC, Korsak Holdings, LLC and Madetys Investments LLC, except to the extent of his pecuniary interest in such shares of common stock. Excludes options to purchase 20,000 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022. |

| (9) | Includes Mr. House’s options to purchase 280,000 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022. Excludes options to purchase 20,000 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022. |

| (10) | Includes Mr. Henning’s options to purchase 92,500 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022. Excludes options to purchase 20,000 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022. |

| (11) | Includes Ms. Ottmann’s options to purchase 15,000 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022. |

6

| (12) | Includes Mr. Walbrecht’s options to purchase 533,334 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022. Excludes (i) Mr. Walbrecht’s options to purchase 366,666 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022; (ii) stock award of 112,500 shares of restricted common stock granted on January 7, 2019 under the Company’s 2015 Stock Incentive Plan of which (A) 37,500 shares of the Company’s common stock shall vest on each of January 28, 2023, January 28, 2024 and January 28, 2025; and (iii) a stock award of 100,000 shares of restricted common stock granted to Mr. Walbrecht on March 4, 2022 under the Company’s 2015 Stock Incentive Plan all of which shall vest if on or before March 4, 2032, the Fair Market Value (as defined in the 2015 Stock Incentive Plan) of the common stock shall have equaled or exceeded $50.00 per share for twenty consecutive trading days. |

| (13) | Includes Mr. Kuehne’s options to purchase 762,500 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022. Excludes (i) Mr. Kuehne’s options to purchase 300,000 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022; and (ii) a stock award of 100,000 shares of restricted common stock granted to Mr. Kuehne on March 4, 2022 under the Company’s 2015 Stock Incentive Plan all of which shall vest if on or before March 4, 2032, the Fair Market Value (as defined in the 2015 Stock Incentive Plan) of the common stock shall have equaled or exceeded $50.00 per share for twenty consecutive trading days. |

| (14) |

Excludes Mr. Yate’s options to purchase 30,000 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022.

|

| (15) | Includes options to purchase 2,501,167 shares of common stock that are presently exercisable or exercisable within 60 days of April 18, 2022. Excludes (i) options to purchase 1,027,330 shares of common stock that are not presently exercisable and not exercisable within 60 days of April 18, 2022; and (ii) 1,545,833 shares of restricted common stock that are not presently vested and will not vest within 60 days of April 18, 2022. |

We are not aware of any material proceedings to which any of our directors, nominees for director, executive officers, affiliates of the foregoing persons or any security holder, including any owner of record or beneficially of more than five percent (5%) of any class of our voting securities, is a party adverse to us or has a material interest adverse to us.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Bylaws provide that our Board of Directors will consist of not less than three, nor more than seven members, with such number to be fixed by the Board of Directors. The current number of directors has been fixed at six by the Board of Directors. Our Nominating/Corporate Governance Committee and our Board of Directors have selected the six nominees for directors that are listed in this Proxy Statement for election at the Meeting.

Our directors are elected annually at the Annual Meeting of Stockholders. Their respective terms of office will continue until the next Annual Meeting of Stockholders and until their successors have been duly elected and qualified in accordance with our Bylaws. There are no family relationships among any of our directors, nominees for director or executive officers.

Except as otherwise specified or in the case of broker non-votes, each Proxy Card received will be voted for the election of the six nominees for director named below to serve until the next Annual Meeting of Stockholders and until their successors shall have been duly elected and qualified. Each of the nominees named below has been nominated by the Nominating/Corporate Governance Committee of the Board of Directors and has consented to be named a nominee in this Proxy Statement and to serve as a director, if elected. Should any nominee become unable or unwilling to accept a nomination for election, the persons named in the enclosed Proxy Card will vote for the election of a nominee designated by the Board of Directors or will vote for such lesser number of directors as may be prescribed by the Board of Directors in accordance with our Bylaws.

When considering whether directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Nominating/Corporate Governance Committee and the Board of Directors focused primarily on the information discussed in each of the nominee’s individual biographies set forth below, which contains information regarding the person’s service as a director, business experience and director positions held currently or at any time during the last five years.

7

The age and principal occupation of each person nominated as a director is set forth below:

Warren B. Kanders, 64, our Executive Chairman, has served as one of our directors since June 2002 and as Executive Chairman of our Board of Directors since December 2002. Since 1990, Mr. Kanders has served as the President of Kanders & Company, Inc., a private investment firm principally owned and controlled by Mr. Kanders, which makes investments in and provides consulting services to public and private entities. Since April 2012, Mr. Kanders has served as the Chief Executive Officer and a member of the Board of Directors of Cadre Holdings, Inc., a company listed on the New York Stock Exchange since the closing of its initial public offering in November 2021, and a manufacturer and distributer of safety and survivability equipment for first responders. From January 1996 until its sale to BAE Systems plc (“BAE Systems”) on July 31, 2007, Mr. Kanders served as the Chairman of the Board of Directors, and from April 2003 as the Chief Executive Officer, of Armor Holdings, Inc. (“Armor Holdings”), formerly a New York Stock Exchange-listed company and a manufacturer and supplier of military vehicles, armored vehicles, and safety and survivability products and systems to the aerospace and defense, public safety, homeland security, and commercial markets. Mr. Kanders received an A.B. degree in Economics from Brown University. Based upon Mr. Kanders’ role as Executive Chairman of the Company, service as a chairman and a director of a wide range of other public companies, financial background and education, as well as his extensive investment, capital raising, acquisition and operating expertise, the Company believes that Mr. Kanders has the requisite set of skills to serve as a Board member of the Company.

Donald L. House, 80, has served as one of our directors since January 1993. Mr. House served as Chairman of our Board of Directors from January 1994 until December 1997 and as our President from January 1993 until December 1993. Mr. House is currently a private investor, and in the past, he has served on a number of Boards of Directors of public and private companies, including a position as a member of the Board of Directors of Carreker Corporation from May 1998 until March 2007, and as Chairman of Version One, Inc. from January 2003 until August 2017. Mr. House graduated with B.S. and M.S. degrees from the Georgia Institute of Technology. Based upon Mr. House’s role as the Chairman of the Compensation Committee of the Company’s Board of Directors, prior experience as a chairman and an executive officer of companies in a variety of industries, financial expertise and extensive experience serving as a member of the boards of directors and committees of other public companies, the Company believes that Mr. House has the requisite set of skills to serve as a Board or Board committee member of the Company.

Nicholas Sokolow, 72, has served as one of our directors since June 2002, and has been designated as the “lead independent director” of the Company’s Board of Directors since June 2016. Since April 2012, Mr. Sokolow has served as a member of the Board of Directors of Cadre Holdings, Inc., a company listed on the New York Stock Exchange since the closing of its initial public offering in November 2021, and a manufacturer and distributer of safety and survivability equipment for first responders. From January 1996 until its sale to BAE Systems on July 31, 2007, Mr. Sokolow served as a member of the Board of Directors of Armor Holdings. Mr. Sokolow served as a member of the Board of Directors of Stamford Industrial Group, Inc. from October 2006 until September 2009. From 2007 until December 31, 2014, Mr. Sokolow practiced law at the firm of Lebow & Sokolow LLP. From 1994 to 2007, Mr. Sokolow was a partner at the law firm of Sokolow, Carreras & Partners. From June 1973 until October 1994, Mr. Sokolow was an associate and partner at the law firm of Coudert Brothers. Mr. Sokolow graduated with Economics and Finance degrees from the Institut D’Etudes Politiques, a Law degree from the Faculte de Droit and a Masters of Comparative Law degree from the University of Michigan. Mr. Sokolow is also an honorary member of the French Bar. Based upon Mr. Sokolow’s role as the Chairman of the Nominating/Corporate Governance Committee of the Company’s Board of Directors, education, legal background involving mergers and acquisitions, corporate governance expertise and extensive experience serving as a member of the boards of directors and committees of other public companies, the Company believes that Mr. Sokolow has the requisite set of skills to serve as a Board or Board committee member of the Company.

Michael A. Henning, 81, has served as one of our directors since May 2010. Mr. Henning served as a director and the Chairman of the Audit Committee of the Board of Directors of Highlands Acquisition Corp. from May 2007 until September 2009. From 2000 to May 2015, Mr. Henning had served as the Chairman of the Audit Committee and member of the Compensation Committee and had previously served as the Vice Chairman of the Finance Committee, of the Board of Directors of CTS Corporation, a NYSE-listed company that provides electronic components to auto, wireless and PC businesses. From December 2002 to May 2017, Mr. Henning served on the Board of Directors of Omnicom Group Inc., a NYSE-listed global communications company, where he also served on the Audit Committee and the Compensation Committee. From 2007 to May 2017, Mr. Henning served on the Board of Directors of Landstar System, Inc., a NASDAQ-listed transportation and logistics services company, and served on committees such as the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Mr. Henning retired as Deputy Chairman from Ernst & Young in 2000 after forty years with the firm. Mr. Henning was the inaugural Chief Executive Officer of Ernst & Young International, serving from 1993 to 1999. From 1991 to 1993, he served as Vice Chairman of Tax Services at Ernst & Young. Mr. Henning was also the Managing Partner of the firm’s New York office, from 1985 to 1991, and the Partner in charge of International Tax Services, from 1978 to 1985. From 1994 to 2000, Mr. Henning served as a Co-Chairman of the Foreign Investment Advisory Board of Russia, where he co-chaired a panel of 25 chief executive officers from the G-7 countries who advised the Russian government in adopting international accounting and tax standards. Mr. Henning graduated with a B.B.A. degree from St. Francis College and received a Certificate from the Harvard University Advanced Management Program. Mr. Henning is a Certified Public Accountant. Based upon Mr. Henning’s role as the Chairman of the Audit Committee of the Company’s Board of Directors, his accounting and financial expertise and extensive experience serving as a member of the boards of directors and committees of other public companies, the Company believes that Mr. Henning has the requisite set of skills to serve as a Board or Board committee member of the Company.

8

Susan Ottmann, 56, has served as one of our directors since June 2021. Ms. Ottmann has more than 25 years of industrial engineering experience in multiple engineering, marketing, manufacturing and leadership roles for a number of multinational companies. Since August 2018, Ms. Ottmann has served as the graduate program director for Engineering Professional Development in the College of Engineering at the University of Wisconsin-Madison where she also teaches courses in technical leadership and technical project management for both credit and professional development programs. From October 2015 to August 2018, Ms. Ottmann was the business and program director in the College of Engineering at the University of Wisconsin-Madison where she managed the manufacturing systems online master’s program, led technical leadership short course programs and managed the Engineering Professional Development department’s human resource and finance staff as well as business process teams. From September 2013 to July 2015, Ms. Ottmann was the general manager for Thermo Fisher Scientific’s global analytical instrument business where she managed a team of 770 associates with operations in the US, UK. Germany and China as well as sales teams worldwide. From April 2006 to September 2013, Ms. Ottmann served in various roles at Danaher Corporation, including serving as President and Vice President in certain of its global business units. Ms. Ottmann received B.S. degrees in Mechanical Engineering and Engineering & Public Policy from Carnegie Mellon as well as an M.S. degree in Management from North Carolina State University. Based upon Ms. Ottmann’s diverse global business, educational and leadership experience in a variety of engineering, commercial, financial, product development, marketing, and manufacturing roles, the Company believes that Ms. Ottmann has the requisite set of skills to serve as a Board or Board committee member of the Company.

James E. Walker III, 59, has served as one of our directors since February 2022. Mr. Walker has more than 30 years of banking and investment management experience in multiple leadership roles for a number of investment and asset management firms. Since 2021, Mr. Walker has been the Managing Partner and Founder of Vinson Ventures, LLC, a boutique investment firm focused on building and growing early-stage companies by actively working with founders and management. Since November 2017, Mr. Walker has served as a member and lead independent director of the board of directors of Starwood Real Estate Income Trust, Inc., a publicly registered REIT where he also serves on its audit committee. From June 2020 to August 2021, he was the chief executive officer and a partner at Palm Ventures, LLC, a private investment firm in Greenwich, CT, where Mr. Walker managed and oversaw investments in the health and wellness as well as education industries. From April 2008 until December 2016, Mr. Walker served as a managing partner of Fir Tree Partners (“Fir Tree”), a global alternative investment firm with over $10 billion of assets. At Fir Tree, Mr. Walker was jointly responsible for overall firm management, identified new areas of investment opportunity, co-founded Fir Tree’s real estate opportunity funds, co-led the development of Fir Tree’s real estate effort and was also a member of Fir Tree’s real estate investment committee as well as the chairman of its risk committee. Previously, Mr. Walker was a senior member of Kidder, Peabody & Co.’s structured finance group managing proprietary investment vehicle and he began his career in structured finance at Bear Stearns & Co. in its asset-backed securities group. Mr. Walker received a B.S. in Economics from Boston College’s School of Management in 1984 and is a member of the Board of Regents of Boston College. Mr. Walker is also a board member of Team USA, the foundation for the US Olympic Committee. Based upon Mr. Walker’s financial background and education, as well as his extensive investment, capital raising, and operating expertise, the Company believes that Mr. Kanders has the requisite set of skills to serve as a Board or Board committee member of the Company.

9

The affirmative vote of a plurality of the votes cast virtually at the Meeting or represented by proxy at the Meeting is necessary for the election as directors of the six nominees named in this Proxy Statement (assuming a quorum of a majority of the outstanding shares of common stock is present).

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE FOR EACH OF THE ABOVE-NAMED DIRECTOR NOMINEES.

GOVERNANCE OF THE COMPANY

Corporate Governance

Our Board of Directors is committed to sound and effective corporate governance practices. The Company’s management and our Board of Directors reviewed our corporate governance practices in light of the Sarbanes-Oxley Act of 2002. Based on that review, the Board of Directors maintains codes of ethics and conduct, corporate governance guidelines, committee charters, complaint procedures for accounting and auditing matters and an Audit Committee pre-approval policy. The Company is listed on the NASDAQ Global Select Market (“NASDAQ”), and therefore, it has modeled its corporate governance practices after the listing requirements of NASDAQ.

Corporate Governance Guidelines and Documents

The Code of Ethics for Senior Executive Officers and Senior Financial Officers, the Code of Business Conduct and Ethics, Complaint Procedures for Accounting and Auditing Matters, the Corporate Governance Guidelines, and the Charters of our Audit, Compensation and Nominating/Corporate Governance Committees were adopted by Clarus for the purpose of promoting honest and ethical conduct, promoting full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by Clarus, and promoting compliance with all applicable rules and regulations that apply to Clarus and its officers and directors. These policies are available on our Internet website, at www.claruscorp.com, under the tab “Governance Documents” within the section called “Governance.” In addition, you may request a copy of any such materials, without charge, by submitting a written request to: Clarus Corporation, Attention: Secretary, 2084 East 3900 South, Salt Lake City, UT 84124.

Board of Directors

Our Board of Directors is currently comprised of the following six members: Warren B. Kanders, Michael A. Henning, Donald L. House, Susan Ottmann, Nicholas Sokolow and James E. Walker III.

During fiscal 2021, the Board of Directors held 11 meetings, and acted by unanimous written consent in lieu of a meeting four times. During fiscal 2021, all of the directors then in office attended 100% of the total number of meetings of the full Board of Directors, and all of the directors then in office attended 100% of the total number of meetings of the Committees of the Board of Directors on which they served. The Company does not have a formal policy as to Board of Directors attendance at our Annual Meetings of Stockholders. All of the members of our Board of Directors who served as directors during fiscal 2021 attended last year’s virtual Annual Meeting of Stockholders, which was held on June 2, 2021.

Board Leadership Structure

Our Executive Chairman of the Board of Directors is also the principle executive officer of the Company. However, the Company believes that board independence is an important aspect of corporate governance, and the remaining four members of the Board of Directors are therefore independent directors. In addition, our independent directors hold periodically scheduled meetings, at which only independent directors are present. The Board of Directors believes that this leadership structure is appropriate for our Company, given the size and scope of our business, the experience and active involvement of our Executive Chairman and independent directors and our corporate governance practices, which include regular communication with and interaction between and among the President, Executive Vice President, Chief Financial Officer, the Executive Chairman and the independent directors. Mr. Sokolow is designated as the “lead independent director” of the Company’s Board of Directors.

10

Board Role in Risk Oversight

Management is responsible for the day-to-day management of risks the Company faces, while the Board of Directors, as a whole and through its committees, provides risk oversight. In its risk oversight role, the Board of Directors must satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed, including assessing major risk factors relating to the Company and its performance, and reviewing measures to address and mitigate risks. While the full Board of Directors is charged with overseeing risk management, various committees of the Board of Directors and members of management also have responsibilities with respect to our risk oversight. In particular, the Audit Committee plays a large role in monitoring and assessing our financial, legal and operational risks, and receives regular reports from the management team regarding comprehensive organizational risk as well as particular areas of concern.

Director Independence

The Board of Directors has evaluated each of its directors’ independence from Clarus based on the definition of “independence” established by NASDAQ and has determined that Ms. Ottmann and each of Messrs. Henning, House, Sokolow and Walker are independent directors, constituting a majority of the Board of Directors. The Board of Directors has also determined that each of the members of our Audit Committee is “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

In its review of each director’s or nominee’s independence from the Company, the Board of Directors reviewed whether any transactions or relationships currently exist or existed during the past year between each director or nominee and the Company and its subsidiaries, affiliates, equity investors or independent registered public accounting firm. The Board of Directors also examined whether there were any transactions or relationships between each director or nominee and members of the senior management of the Company or their affiliates.

During fiscal 2021, the independent members of the Board held one meeting and also held numerous informal discussions.

Stockholder Communications

Stockholders may send communications to our Board of Directors or any committee thereof by writing to the Board of Directors or any committee thereof at Clarus Corporation, Attention: Secretary, 2084 East 3900 South, Salt Lake City, UT 84124. The Secretary will distribute all stockholder communications to the intended recipients and/or distribute to the entire Board of Directors, as appropriate.

In addition, stockholders may also contact the non-management directors as a group or any individual director by writing to the non-management directors or the individual director, as applicable, at Clarus Corporation, 2084 East 3900 South, Salt Lake City, UT 84124.

Complaint Procedures

Complaints and concerns about accounting, internal accounting controls or auditing or related matters pertaining to the Company may be submitted by writing to the Chairman of the Audit Committee as follows: Clarus Corporation, Attention: Chairman of the Audit Committee, 2084 East 3900 South, Salt Lake City, UT 84124. Complaints may be submitted on a confidential and anonymous basis by sending them in a sealed envelope marked “Confidential.”

Audit Committee

The Audit Committee is responsible for the oversight and evaluation of (i) the qualifications, independence and performance of our independent registered public accounting firm (“independent auditors”); (ii) the performance of our internal audit function; and (iii) the quality and integrity of our financial statements and the effectiveness of our internal control over financial reporting. In addition, the Audit Committee recommends to the Board of Directors the appointment of independent auditors and analyzes the reports and recommendations of such auditors. The Audit Committee also assesses major risk factors relating to the Company and its performance, and reviews measures to address and mitigate financial, legal and operational risks. The committee also prepares the Audit Committee report required by the rules of the U.S. Securities and Exchange Commission (the “SEC”), which is included in this Proxy Statement beginning on page 16.

11

Our Audit Committee is currently comprised of Messrs. Henning, House, Sokolow and Walker, with Mr. Henning serving as the Chairman. All of the members of our Audit Committee were determined by the Board of Directors to be independent of Clarus based on NASDAQ’s definition of “independence” and are able to read and understand the Company’s fundamental financial statements. The Board of Directors has determined that Mr. Henning qualifies as an audit committee financial expert (as such term is defined under the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated thereunder).

The duties of the Audit Committee of our Board of Directors, which are specified in the charter of the Audit Committee, include but are not limited to:

| · | reviewing and discussing with management and the independent auditors the annual audited financial statements, and recommending to our Board of Directors whether the annual audited financial statements should be included in our Annual Report on Form 10-K; |

| · | discussing with management and the independent auditors significant financial reporting issues and judgments made in connection with the preparation of our financial statements; |

| · | discussing with management major risk assessment and risk management policies; |

| · | monitoring the independence of the independent auditors; |

| · | verifying the rotation of the lead audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by regulation; |

| · | reviewing and approving all related party transactions; |

| · | inquiring and discussing with management our compliance with applicable laws and regulations; |

| · | pre-approving all audit services and permitted non-audit services to be performed by our independent auditors, including the fees and terms of the services to be performed; |

| · | appointing and replacing the independent auditors; |

| · | determining the compensation and oversight of the work of the independent auditors (including resolution of disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing and issuing an audit report or related work; |

| · | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or reports which raise material issues regarding our financial statements or accounting policies; and |

| · | approving reimbursement of expenses incurred by our management team in identifying potential target businesses. |

During fiscal 2021, the Audit Committee held 5 meetings and acted by unanimous written consent in lieu of a meeting twice. The Board of Directors has adopted a written Charter for the Audit Committee, a copy of which is available on our Internet website, at www.claruscorp.com, under the tab “Governance Documents” within the section called “Governance.”

12

Compensation Committee

The Compensation Committee reviews recommendations for executive compensation, including incentive compensation and stock incentive plans and makes recommendations to the Board of Directors concerning levels of compensation of our executive officers and other key managerial personnel as well as the adoption of incentive and stock plans. Pursuant to the Compensation Committee’s charter (a copy of which is available on our Internet website, at www.claruscorp.com, under the tab “Governance Documents” within the section called “Governance”), the Compensation Committee’s authority generally includes, among other things, the authority to do each of the following:

| · | To assist the Board of Directors in developing and evaluating potential candidates for executive positions and to oversee the development of executive succession plans. |

| · | To review and approve corporate goals and objectives with respect to compensation for the Company’s senior management team, evaluate the senior management team’s performance in light of those goals and objectives, and, either as a committee or together with the other independent directors, determine and approve the senior management team’s compensation levels based on this evaluation. In determining the long-term incentive component of the senior management team’s compensation, the Compensation Committee shall consider the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers at comparable companies, and the awards given to the Company’s senior management team in past years. |

| · | To make recommendations to the Board of Directors with respect to non-senior management team compensation, incentive-compensation plans and equity-based plans. The Compensation Committee shall also provide oversight of senior management’s decisions concerning the performance and compensation of other Company officers. |

| · | To review the Company’s incentive compensation and other stock-based plans and recommend changes in such plans to the Board of Directors as needed. The Compensation Committee shall have and shall exercise all the authority of the Board of Directors with respect to the administration of such plans. |

| · | To produce the compensation committee report on executive compensation to be included in the Company’s Proxy Statement. |

| · | To review on an annual basis director compensation and benefits. |

The Compensation Committee has the authority to retain or obtain advice from, as well as determine the appropriate compensation of, such compensation consultants, outside counsel and other advisors as the Compensation Committee, in its sole discretion, may deem appropriate.

Our Compensation Committee is currently comprised of Messrs. House and Sokolow and Ms. Ottmann, with Mr. House serving as the Chairman, all of whom were determined by the Board of Directors to be independent of the Company based on NASDAQ’s definition of “independence”. The Compensation Committee does not formally meet on a regular basis, but only as circumstances require. During fiscal 2021, the Compensation Committee held one meeting, acted by unanimous written consent in lieu of a meeting twice, and also held numerous informal discussions.

Nominating/Corporate Governance Committee

The purpose of the Nominating/Corporate Governance Committee is to identify, evaluate and nominate candidates for election to the Board of Directors, as well as review Clarus’ corporate governance guidelines and other related documents for compliance with applicable laws and regulations such as the Sarbanes-Oxley Act of 2002 and the NASDAQ listing requirements. The Nominating/Corporate Governance Committee considers all qualified candidates identified by members of the Committee, by other members of the Board of Directors, and by senior management. The Nominating/Corporate Governance Committee will consider nominees recommended by stockholders. Information with respect to a proposed nominee should be forwarded to Clarus Corporation, Attention: Secretary, at 2084 East 3900 South, Salt Lake City, UT 84124, and upon receipt, the Secretary will submit them to the Nominating/Corporate Governance Committee for its consideration. Such information shall include the name of the nominee, and such information with respect to the nominee as would be required under the rules and regulations of the SEC to be included in our Proxy Statement if such proposed nominee were to be included therein, as well as a consent executed by the proposed nominee to serve as director if elected as required by the rules and regulations of the SEC. In addition, the stockholder shall include a statement to the effect that the proposed nominee has no direct or indirect business conflict of interest with us, and otherwise meets our standards set forth below. See “Requirements for Submission of Stockholder Proposals, Nomination of Directors and Other Business of Stockholders” for additional information on certain procedures that a stockholder must follow to nominate persons for election as directors.

13

Our Nominating/Corporate Governance Committee is currently comprised of Messrs. Sokolow and House, with Mr. Sokolow serving as the Chairman, both of whom were determined by the Board of Directors to be independent of the Company based on NASDAQ’s definition of “independence. The Nominating/Corporate Governance Committee does not formally meet on a regular basis, but only as circumstances require. During fiscal 2021, the Nominating/Corporate Governance Committee held three meetings, acted by unanimous written consent in lieu of a meeting once and held several informal meetings, in person and by telephone, to discuss various topics relevant to its function, including evaluating the composition, structure and qualifications of the Board of Directors. A copy of the Nominating/Corporate Governance Committee’s Charter is available on our Internet website, at www.claruscorp.com, under the tab “Governance Documents” within the section called “Governance.”

Candidates for the Board of Directors should possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility; have a genuine interest in the Company; have no conflict of interest or legal impediment which would interfere with the duty of loyalty owed to the Company and its stockholders; and have the ability and willingness to spend the time required to function effectively as a director of the Company. The Nominating/Corporate Governance Committee does not have a formal policy with regard to the consideration of diversity in identifying candidates for director. Nevertheless, the Nominating/Corporate Governance Committee’s evaluation of director candidates takes into account their ability to contribute to the diversity of age, background, experience, viewpoints and other individual qualities and attributes represented on the Board of Directors.

The Nominating/Corporate Governance Committee may engage third-party search firms from time to time to assist it in identifying and evaluating nominees for director. The Nominating/Corporate Governance Committee evaluates nominees recommended by stockholders, by other individuals and by the search firms in the same manner, as follows: The Nominating/Corporate Governance Committee reviews biographical information furnished by or about the potential nominees to determine whether they have the experience and qualities discussed above; when a Board of Directors vacancy occurs or is anticipated, the Nominating/Corporate Governance Committee determines which of the qualified candidates to interview, based on the current needs of the Board of Directors and the Company, and members of the Nominating/Corporate Governance Committee meet with these individuals. If, after such meetings, the Nominating/Corporate Governance Committee determines to recommend any candidate to the Board of Directors for consideration, that individual is invited to meet with the entire Board of Directors. The Board of Directors then determines whether to select the individual as a director-nominee.

Director Summary Compensation Table

The following table summarizes the compensation earned by our serving non-employee directors for the fiscal year ended December 31, 2021:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Non-qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||

| Michael A. Henning | 50,000 | - | 106,301 | (2) | - | - | - | 156,301 | ||||||||||||||||||||

| Donald L. House | 45,000 | - | 106,301 | (3) | - | - | - | 151,301 | ||||||||||||||||||||

| Susan Ottmann | 20,417 | - | 106,301 | (4) | - | - | - | 126,718 | ||||||||||||||||||||

| Nicholas Sokolow | 55,000 | - | 106,301 | (5) | - | - | - | 161,301 | ||||||||||||||||||||

14

(1) Represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for awards made during the applicable year. For discussions on the relevant assumptions, see footnote 11, “Stock-Based Compensation Plan” in the financial statements contained in the Annual Report on Form 10-K for the year ended December 31, 2021.

(2) Mr. Henning’s option awards consist of the grant of 12,500 options on June 2, 2021, valued at $106,301 and fully vesting on March 31, 2022.

(3) Mr. House’s option awards consist of the grant of 12,500 options on June 2, 2021, valued at $106,301 and fully vesting on March 31, 2022.

(4) Ms. Ottmann’s option awards consist of the grant of 12,500 options on June 2, 2021, valued at $106,301 and fully vesting on March 31, 2022.

(5) Mr. Sokolow’s option awards consist of the grant of 12,500 options on June 2, 2021, valued at $106,301 and fully vesting on March 31, 2022.

Discussion of Director Compensation

We pay three primary components of compensation to our non-management directors: an annual cash retainer, committee chairman fees, and equity awards, generally comprising of stock equity awards such as stock options. In setting director compensation, the Company considers the significant amount of time that directors expend in fulfilling their duties on our Board of Directors and its committees as well as the skill level required by the Company of members of the Board of Directors and the need to continue to attract highly qualified candidates to serve on our Board of Directors. Director compensation arrangements are reviewed annually to maintain such standards.

In 2021, members of our Board of Directors were compensated as follows: (i) the non-employee directors each received an annual stock option grant at the Annual Meeting of Stockholders of 12,500 shares at an exercise price equal to the closing price of the Company’s common stock on the date of such grant, and vesting and becoming exercisable in four equal consecutive quarterly tranches; (ii) all non-employee directors serving on the Board of Directors received an annual payment of $35,000, payable in equal quarterly installments, in consideration for their services on the Board; (iii) Mr. Sokolow, the lead independent director of the Board of Directors, received an additional annual payment of $10,000, payable in equal, quarterly installments, in consideration of his service as the lead independent director of the Board of Directors, (iv) the chairmen of the respective Board committees, other than the Board of Directors’ Audit Committee, received an additional annual payment of $10,000, payable in equal quarterly installments, in consideration for their services as chairmen on the respective Board of Directors’ committees; and (v) the chairman of the Board of Directors’ Audit Committee received an additional annual payment of $15,000, payable in equal quarterly installments, in consideration for his service as the chairman of the Board of Directors’ Audit Committee. Commencing with the 2022 Meeting, the annual stock option grant of 12,500 stock options awarded to each of the Company’s non-employee directors following each of the Company’s Annual Meeting of Stockholders will be increased to 15,000 stock options.

In 2021, our current employee director, Mr. Kanders, was compensated pursuant to his employment agreement (which is described below under the heading “Employment Agreements”).

15

Involvement in Certain Legal Proceedings

No director, executive officer or person nominated to become a director or executive officer has, within the last ten years: (i) had a bankruptcy petition filed by or against, or a receiver, fiscal agent or similar officer appointed by a court for, any business of such person or entity with respect to which such person was a general partner or executive officer either at the time of the bankruptcy filing or within two years prior to that time; (ii) been convicted in a criminal proceeding or is currently subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (iii) been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting his involvement in any type of business, securities or banking activities or practice; or (iv) been found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Board of Directors has appointed an Audit Committee consisting of three directors. Each of the members of the Audit Committee is independent from Clarus and is financially literate as that qualification is interpreted by the Board of Directors. The Board of Directors has adopted a written charter with respect to the Audit Committee’s roles and responsibilities.

Management is responsible for Clarus’ internal control and the financial reporting process. The external auditor is responsible for performing an independent audit of Clarus’ consolidated financial statements and internal control over financial reporting in accordance with auditing standards and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

The Audit Committee has had various discussions with management and the independent auditors. Management represented to the Audit Committee that Clarus’ consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles applied on a consistent basis, and the Audit Committee has reviewed and discussed the quarterly and annual consolidated financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditors the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications with Audit Committees.

The Audit Committee has received the written disclosures and a letter from the independent registered public accounting firm as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm its independence from Clarus and its management. The Audit Committee also considers whether the independent registered public accounting firm’s provision of audit and non-audit services to Clarus is compatible with maintaining the independent registered public accounting firm’s independence.

The Audit Committee discussed with the independent auditors the overall scope and plans for its audit. The Audit Committee discussed with the independent auditors, with and without management present, the results of its audit, the evaluations of Clarus’ internal control over financial reporting, and the overall quality and integrity of financial reporting.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements and the audit report on the audited financial statements and internal control over financial reporting be included in Clarus’ Annual Report on Form 10-K for the fiscal year ended December 31, 2021, for filing with the SEC.

Submitted by the Members of the Audit Committee of the Board of Directors:

Michael A. Henning (Chairman)

Donald L. House

Nicholas Sokolow

James E. Walker III

16

The Report of the Audit Committee does not constitute soliciting material, and shall not be deemed to be filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except to the extent that the Company specifically incorporates the Report of the Audit Committee by reference therein.

EXECUTIVE OFFICERS

The following table sets forth the name, age and position of each of our executive officers as of the date hereof. Our executive officers are appointed by and serve at the discretion of the Board of Directors of Clarus.

| Name | Age | Position | ||||

| Warren B. Kanders | 64 | Executive Chairman of the Board of Directors | ||||

| John C. Walbrecht | 54 | President | ||||

| Aaron J. Kuehne | 43 | Executive Vice President, Chief Operating Officer, Secretary and Treasurer | ||||

| Michael J. Yates | 56 | Chief Financial Officer | ||||

See “Biographical Information for Directors” for biographical information with respect to Warren B. Kanders.

John C. Walbrecht, 54, has served as the President of the Company since October 2017, and President of BDEL since October 2016. Before joining the Company, Mr. Walbrecht served as the President of Mountain Hardwear from March 2016 to October 2016. Prior to Mountain Hardwear, Mr. Walbrecht served as the President and Chief Executive Officer of Fenix Outdoors NA from January 2012 until March 2016. Mr. Walbrecht has also served in various senior roles with Brandbase, Spyder, Dr. Martens/Airwair, and Timberland. Mr. Walbrecht holds a Master of Business Administration and a Bachelor of Science in Economics from Brigham Young University, a Bachelor of Arts in Marketing from the University of Maryland and understudies in International Trade and Finance at Cambridge University - Trinity College.

Aaron J. Kuehne, 43, has served as our Chief Operating Officer since January 2022, as our Executive Vice President since March 2021 and as our Secretary and Treasurer, since 2013. Mr. Kuehne previously served as the Company’s Chief Financial Officer, Chief Administrative Officer, interim Chief Financial Officer, in addition to serving as its Vice President of Finance, principal financial officer and principal accounting officer. Before joining the Company in September 2010, Mr. Kuehne served as the Corporate Controller of Certiport from August 2009 to September 2010. From July 2004 to August 2009, Mr. Kuehne served in various capacities with KPMG LLP, most recently as Audit Manager. Mr. Kuehne graduated with a Bachelor of Arts degree in Accounting from University of Utah – David Eccles School of Business in 2002 and with an M.B.A. degree from University of Utah – David Eccles School of Business in 2004. He has also been a Certified Public Accountant since 2005.

Michael J. Yates, 56, has served as our Chief Financial Officer since January 2022. Before joining the Company, Mr. Yates was with IDEX Corporation from October 2005 to January 2022, serving as the corporate controller from 2005 to 2010, the chief accounting officer from 2010 to 2022 and the interim chief financial officer from September 2016 to December 2017. Over his career at IDEX Corporation Mr. Yates had responsibility for several corporate and operating finance functions and was the principal accounting officer. Prior to IDEX Corporation, Mr. Yates spent 18 years in public accounting with KPMG LLP and PricewaterhouseCoopers LLP in various roles from 1987 to 2005. Mr. Yates graduated from Indiana University’s Kelly School of Business in 1987 with a Bachelor of Science degree in Accounting.

There are no family relationships between our Named Executive Officers and any director of the Company.

17

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

The Compensation Committee assists the independent members of the Board of Directors in establishing a compensation package for Clarus’ Executive Chairman and assists the Board of Directors in establishing compensation packages for Clarus’ other Named Executive Officers, its key employees and non-employee directors as well as administering Clarus’ incentive plans. The Compensation Committee is generally responsible for setting and administering the policies which govern annual salaries of executive officers, raises and bonuses and certain awards of stock options and common stock under the Company’s 2015 Stock Incentive Plan and otherwise, and such responsibility is generally limited to the actions taken by the Compensation Committee, although at times the full Board of Directors has determined annual executive salaries, raises and bonuses as well as grants of stock options and common stock without having first received recommendations from the Compensation Committee. From time to time, the Compensation Committee reviews our compensation packages to ensure that they remain competitive with the compensation packages offered by similarly situated companies and continue to incentivize management and align management’s interests with those of our stockholders. Although we do not target executive compensation to any peer group median, we strive to provide a compensation package that is competitive in the market and rewards each executive’s performance.

The Compensation Committee is comprised of three directors, each of whom has considerable experience in executive compensation issues. Each member of the Compensation Committee meets the independence requirements specified by NASDAQ and by Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). No member of the Compensation Committee has ever been an officer or employee of the Company, nor is there a direct or indirect relationship between any of the members of the Committee and any of the Company’s executive officers. The Compensation Committee operates under a written charter adopted by the Board of Directors that is available on our Internet website, at www.claruscorp.com, under the tab “Governance Documents” within the section called “Governance.”

Executive Compensation Philosophy and Objectives