|

Delaware

|

58-1972600

|

|

(State

of Incorporation)

|

(I.R.S.

Employer Identification No.)

|

|

PAGE

|

||

|

1

|

||

|

1

|

||

|

1

|

||

|

1

|

||

|

2

|

||

|

3

|

||

|

3

|

||

|

4

|

||

|

9

|

||

|

10

|

||

|

10

|

||

|

10

|

||

|

11

|

||

|

14

|

||

|

15

|

||

|

23

|

||

|

24

|

||

|

45

|

||

|

45

|

||

|

46

|

||

|

46

|

||

|

46

|

||

|

46

|

||

|

46

|

||

|

46

|

||

|

|

||

|

47

|

||

|

50

|

||

|

53

|

||

| - |

On

May 26, 1998, we completed an initial public offering of our common

stock

in which we sold 2.5 million shares of common stock at $10.00 per

share,

resulting in net proceeds to us of approximately $22.0 million.

|

| - |

On

October 18, 1999, we sold substantially all of the assets of our

financial

and human resources software ("ERP") business to Geac Computer Systems,

Inc. and Geac Canada Limited. In this sale, we received approximately

$13.9 million.

|

| - |

On

March 10, 2000, we sold 2,243,000 shares of common stock in a secondary

public offering at $115.00 per share resulting in net proceeds to

us of

approximately $244.4 million.

|

| • |

rules

and regulations or currency conversion or corporate withholding taxes

on

individuals;

|

| • |

tariffs

and trade barriers;

|

| • |

regulations

related to customs and import/export matters;

|

| • |

longer

payment cycles;

|

| • |

tax

issues, such as tax law changes and variations in tax laws as compared

to

the United States;

|

| • |

currency

fluctuations and exchange controls;

|

| • |

challenges

in collecting accounts receivable;

|

| • |

cultural

and language differences;

|

| • |

employment

regulations;

|

| • |

crime,

strikes, riots, civil disturbances, terrorist attacks and wars; and

|

| • |

deterioration

of political relations with the United States.

|

|

High

|

Low

|

||||||

|

Calendar

Year 2008

|

|||||||

|

First

Quarter (through March 3, 2008)

|

$

|

6.40

|

$

|

5.60

|

|||

|

Year

ended December 31, 2007

|

|||||||

|

First

Quarter

|

$

|

8.20

|

$

|

7.05

|

|||

|

Second

Quarter

|

$

|

9.80

|

$

|

8.05

|

|||

|

Third

Quarter

|

$

|

9.85

|

$

|

6.75

|

|||

|

Fourth

Quarter

|

$

|

7.30

|

$

|

5.73

|

|||

|

Year

ended December 31, 2006

|

|||||||

|

First

Quarter

|

$

|

8.45

|

$

|

6.90

|

|||

|

Second

Quarter

|

$

|

7.19

|

$

|

6.30

|

|||

|

Third

Quarter

|

$

|

7.34

|

$

|

6.40

|

|||

|

Fourth

Quarter

|

$

|

7.50

|

$

|

6.70

|

|||

|

|

|

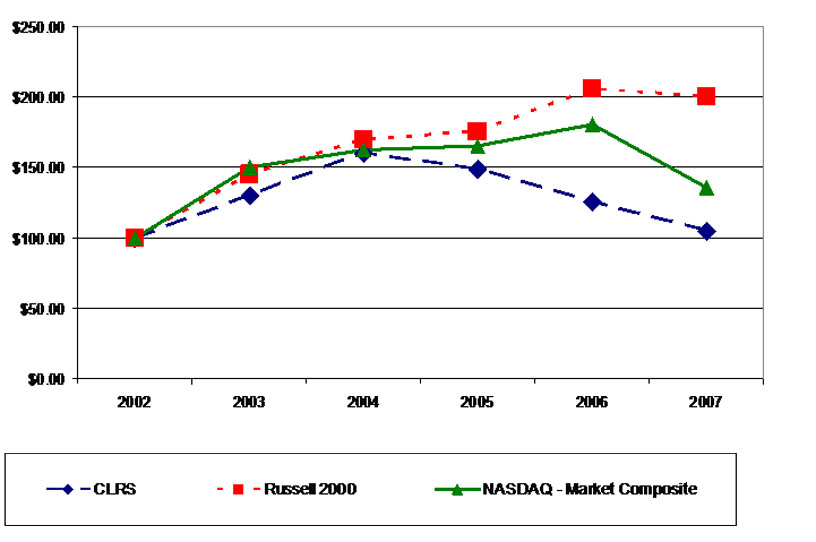

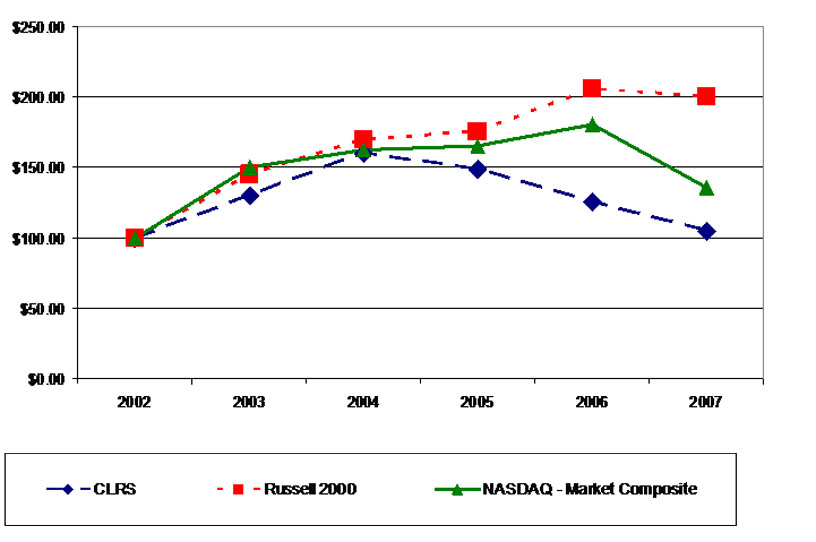

12/31/02

|

|

12/31/03

|

|

12/31/04

|

|

12/31/05

|

|

12/31/06

|

|

12/31/07

|

|

CLARUS

CORPORATION

|

|

$100.00

|

|

$129.89

|

|

$160.14

|

|

$148.58

|

|

$125.44

|

|

$104.98

|

|

NASDAQ

NATIONAL MARKET COMPOSITE

|

|

$100.00

|

|

$150.01

|

|

$162.89

|

|

$165.14

|

|

$180.85

|

|

$135.99

|

|

THE

RUSSELL 2000 INDEX

|

|

$100.00

|

|

$145.37

|

|

$170.08

|

|

$175.73

|

|

$205.61

|

|

$199.96

|

|

Plan

Category

|

(A)

Number

of securities to be issued upon exercise of outstanding options,

warrants

and rights

|

(B)

Weighted-average

exercise price of outstanding options, warrants and rights

|

(C)

Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column

(A))Number

of securities remaining available for future issuance under equity

compensation plans (excluding securities reflected in column

(a))

|

|||||||

|

Equity

compensation plans approved by security holders (1)

|

1,248,750

|

$

|

5.98

|

3,771,847

|

||||||

|

Equity

compensation plans not approved by security holders (2) (3)

(4)

|

1,100,000

|

$

|

7.83

|

—

|

||||||

|

Total

|

2,348,750

|

$

|

6.84

|

3,771,847

|

||||||

| (1) |

Consists

of stock options and restricted stock awards issued under the Amended

and

Restated Stock Incentive Plan of Clarus Corporation (the “2000 Plan”).

Also consists of stock options issued and issuable under the 2005

Clarus

Corporation Stock Incentive Plan (the “2005 Plan”).

|

| (2) |

Includes

options granted to the Company’s Executive Chairman, Warren B. Kanders to

purchase 400,000 shares of common stock, having an exercise price

of $7.50

per share.

|

| (3) |

Includes

options granted to the Company’s Executive Chairman, Warren B. Kanders to

purchase 400,000 shares of common stock, having an exercise price

of

$10.00 per share.

|

| (4) |

Includes

300,000 shares of restricted stock granted to the Company’s Executive

Chairman, Warren B. Kanders, having voting, dividend, distribution

and

other rights, which shall vest and become nonforfeitable if Mr. Kanders

is

an employee and/or a director of the Company or a subsidiary or affiliate

of the Company on the earlier of (i) the date the closing price of

the

Company’s common stock equals or exceeds $15.00 per share for each of the

trading days during a ninety consecutive day period, or (ii) April

11,

2013, subject to acceleration in certain

circumstances.

|

|

Years

ended December 31,

|

||||||||||||||||

|

2007

|

2006

|

2005

|

2004

|

2003

|

||||||||||||

|

(in

thousands, except per share data)

|

||||||||||||||||

|

Statement

of Operations Data:

|

||||||||||||||||

|

Revenues:

|

||||||||||||||||

|

License

fees

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

1,106

|

$

|

—

|

||||||

|

Service

fees

|

—

|

—

|

—

|

—

|

130

|

|||||||||||

|

Total

Revenues

|

—

|

—

|

—

|

1,106

|

130

|

|||||||||||

|

Operating

expenses:

|

||||||||||||||||

|

General

and administrative

|

3,767

|

3,530

|

3,504

|

3,395

|

4,986

|

|||||||||||

|

Provision

for doubtful accounts

|

—

|

—

|

—

|

—

|

18

|

|||||||||||

|

Transaction

expense

|

(13

|

)

|

1,431

|

(59

|

)

|

1,636

|

—

|

|||||||||

|

Loss

on sale or disposal of assets

|

—

|

—

|

—

|

—

|

36

|

|||||||||||

|

Depreciation

|

359

|

346

|

334

|

186

|

762

|

|||||||||||

|

Total

Operating Expenses

|

4,113

|

5,307

|

3,779

|

5,217

|

5,802

|

|||||||||||

|

Operating

Loss

|

(4,113

|

)

|

(5,307

|

)

|

(3,779

|

)

|

(4,111

|

)

|

(5,672

|

)

|

||||||

|

Other

income (expense)

|

(6

|

)

|

—

|

(2

|

)

|

19

|

169

|

|||||||||

|

Interest

income

|

4,239

|

4,016

|

2,490

|

1,203

|

1,238

|

|||||||||||

|

Interest

expense

|

—

|

—

|

—

|

—

|

(66

|

)

|

||||||||||

|

Net

Income (Loss) Before Income Tax

|

$

|

120

|

$

|

(1,291

|

)

|

$

|

(1,291

|

)

|

$

|

(2,889

|

)

|

$

|

(4,331

|

)

|

||

|

Income

tax

|

3

|

—

|

—

|

—

|

—

|

|||||||||||

|

Net

Income (Loss)

|

$

|

117

|

$

|

(1,291

|

)

|

$

|

(1,291

|

)

|

$

|

(2,889

|

)

|

$

|

(4,331

|

)

|

||

|

Income

(Loss) Per Share

|

||||||||||||||||

|

Basic

|

$

|

0.01

|

$

|

(0.08

|

)

|

$

|

(0.08

|

)

|

$

|

(0.18

|

)

|

$

|

(0.27

|

)

|

||

|

Diluted

|

$

|

0.01

|

$

|

(0.08

|

)

|

$

|

(0.08

|

)

|

$

|

(0.18

|

)

|

$

|

(0.27

|

)

|

||

|

Weighted

Average Common Shares Outstanding

|

||||||||||||||||

|

Basic

|

16,658

|

16,613

|

16,329

|

16,092

|

15,905

|

|||||||||||

|

Diluted

|

17,051

|

16,613

|

16,329

|

16,092

|

15,905

|

|||||||||||

|

Balance

Sheet Data:

|

As

of December 31,

|

|||||||||||||||

|

2007

|

2006

|

2005

|

2004

|

2003

|

||||||||||||

|

Cash

and cash equivalents

|

$

|

41,886

|

$

|

1,731

|

$

|

23,270

|

$

|

48,377

|

$

|

15,045

|

||||||

|

Marketable

securities

|

$

|

45,223

|

$

|

82,634

|

$

|

61,601

|

$

|

35,119

|

$

|

73,685

|

||||||

|

Total

assets

|

$

|

88,680

|

$

|

86,673

|

$

|

88,278

|

$

|

86,437

|

$

|

89,445

|

||||||

|

Total

stockholders' equity

|

$

|

87,719

|

$

|

85,716

|

$

|

86,609

|

$

|

84,854

|

$

|

86,819

|

||||||

| - |

The

Company accounts for its marketable securities under the provisions

of

Statement of Financial Accounting Standards ("SFAS") No. 115, "Accounting

for Certain Investments in Debt and Equity Securities". Pursuant

to the

provisions of SFAS No. 115, the Company has classified its marketable

securities as available-for-sale. Available-for-sale securities have

been

recorded at fair value and

related unrealized gains and losses have been excluded from earnings

and

are reported as a separate component of accumulated other comprehensive

income (loss) until realized.

|

| - |

The

Company accounts for income taxes pursuant to Statement of Financial

Accounting Standards No. 109, "Accounting for Income Taxes" ("SFAS

109").

Under the asset and liability method specified thereunder, deferred

taxes

are determined based on the difference between the financial reporting

and

tax bases of assets and liabilities. Deferred tax liabilities are

offset

by deferred tax assets relating to net operating loss carryforwards,

tax

credit carryforwards and deductible temporary differences. Recognition

of

deferred tax assets is based on management’s belief that it is more likely

than not that the tax benefit associated with temporary differences

and

operating and capital loss carryforwards will be utilized. A valuation

allowance is recorded for those deferred tax assets for which it

is more

likely than not that the realization will not

occur.

|

| - |

On

January 1, 2006, the Company adopted Statement of Financial Accounting

Standards No. 123 (revised 2004), “Share-Based Payments” (“SFAS 123R”),

requiring recognition of expense related to the fair value of stock

option

awards. The Company recognizes the cost of the share-based awards

on a

straight-line basis over the requisite service period of the award.

Prior

to January 1, 2006, the Company accounted for stock option plans

under the

recognition and measurement provisions of Accounting Principles Board

Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”) and

related interpretations, as permitted by Statement of Financial Accounting

Standard No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”).

Under SFAS 123R, compensation cost recognized during 2007 and 2006

would

include: (a) compensation cost for all share-based payments granted

prior

to, but not yet vested as of January 1, 2006, based on the grant

date fair

value estimated in accordance with the original provisions of SFAS

123,

and (b) compensation cost for all share-based payments granted subsequent

to January 1, 2006, based on the grant-date fair value estimated

in

accordance with the provisions of SFAS 123R.

|

| - |

Through

2004, the Company had recognized revenue in connection with its prior

business from two primary sources, software licenses and services.

Revenue

from software licensing and services fees was recognized in accordance

with Statement of Position ("SOP") 97-2, "Software Revenue Recognition",

and SOP 98-9, "Software Revenue Recognition with Respect to Certain

Transactions" and related interpretations. The Company recognized

software

license revenue when: (1) persuasive evidence of an arrangement existed;

(2) delivery had occurred; (3) the fee was fixed or determinable;

and (4)

collectibility was probable.

|

|

Options

Vesting Period

|

1

year

|

4

years

|

|||||

|

Dividend

Yield

|

0.00

|

%

|

0.00

|

%

|

|||

|

Expected

volatility

|

31.8

|

%

|

40.9

|

%

|

|||

|

Risk-free

interest rate

|

3.54

|

%

|

3.80

|

%

|

|||

|

Expected

life

|

5.75

years

|

6.25

years

|

|||||

|

Weighted

average fair value

|

$

|

2.22

|

$

|

2.77

|

|||

|

Net

Operating Loss

|

Capital

Loss

|

||||||

|

Expiration

Dates

December

31

|

Amount

(000’s)

|

Amount

(000’s)

|

|||||

|

2007

|

$

|

—

|

$

|

0

|

|||

|

2008

|

—

|

1,599

|

|||||

|

2009

|

1,900

|

||||||

|

2010

|

7,417

|

||||||

|

2011

|

7,520

|

||||||

|

2012

|

5,157

|

||||||

|

2020

|

29,533

|

||||||

|

2021

|

50,430

|

||||||

|

2022

|

115,000

|

||||||

|

2023

|

5,712

|

||||||

|

2024

|

3,566

|

||||||

|

2025

|

1,707

|

||||||

|

2026

|

476

|

||||||

|

Total

|

228,418

|

1,599

|

|||||

|

Section

382 limitation

|

(5,363

|

)

|

—

|

||||

|

After

Limitations

|

$

|

223,055

|

$

|

1,599

|

|||

|

*Subject

to compliance with Section 382 of the Internal Revenue

Code.

|

|||||||

|

Contractual

Obligations

|

||||||||||||||||

|

(in

thousands)

|

Payment

Due By Period

|

|||||||||||||||

|

|

Less

Than

|

More

Than

|

||||||||||||||

|

Total

|

1

Year

|

1-3

Years

|

3-5

Years

|

5

Years

|

||||||||||||

|

Operating

Leases

|

$

|

2,425

|

$

|

420

|

$

|

877

|

$

|

1,128

|

$

|

—

|

||||||

|

Total

|

$

|

2,425

|

$

|

420

|

$

|

877

|

$

|

1,128

|

$

|

—

|

||||||

|

2007

|

|||||||||||||

|

First

|

Second

|

Third

|

Fourth

|

||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

||||||||||

|

Revenues

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

|||||

|

Operating

loss

|

$

|

(

874

|

)

|

$

|

(

998

|

)

|

$

|

(1,050

|

)

|

$

|

(1,191

|

)

|

|

|

Net

income (loss) before taxes

|

$

|

202

|

$

|

81

|

$

|

36

|

$

|

(199

|

)

|

||||

|

Net

income (loss)

|

$

|

202

|

$

|

81

|

$

|

36

|

$

|

(202

|

)

|

||||

|

Net

income (loss) per share:

|

|||||||||||||

|

Basic

|

$

|

0.01

|

$

|

0.00

|

$

|

0.00

|

$

|

(0.01

|

)

|

||||

|

Diluted

|

$

|

0.01

|

$

|

0.00

|

$

|

0.00

|

$

|

(0.01

|

)

|

||||

|

2006

|

|||||||||||||

|

First

|

Second

|

Third

|

Fourth

|

||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

||||||||||

|

Revenues

|

$

|

—

|

$

|

—

|

$

|

—

|

$

|

—

|

|||||

|

Operating

loss

|

(2,249

|

)

|

(1,019

|

)

|

(961

|

)

|

(1,078

|

)

|

|||||

|

Net

income (loss)

|

$

|

(1,382

|

)

|

$

|

(24

|

)

|

$

|

99

|

$

|

16

|

|||

|

Net

income (loss) per share:

|

|||||||||||||

|

Basic

|

$

|

(0.08

|

)

|

$

|

(0.00

|

)

|

$

|

0.01

|

$

|

0.00

|

|||

|

Diluted

|

$

|

(0.08

|

)

|

$

|

(0.00

|

)

|

$

|

0.01

|

$

|

0.00

|

|||

|

Page

|

|

|

25

|

|

|

26

|

|

|

27

|

|

|

28

|

|

|

30

|

|

|

31

|

|

ASSETS

|

|||||||

|

2007

|

2006

|

||||||

|

CURRENT

ASSETS:

|

|||||||

|

Cash

and cash equivalents

|

$

|

41,886

|

$

|

1,731

|

|||

|

Marketable

securities

|

45,223

|

82,634

|

|||||

|

Interest

receivable

|

15

|

402

|

|||||

|

Prepaids

and other current assets

|

175

|

207

|

|||||

|

Total

current assets

|

87,299

|

84,974

|

|||||

|

PROPERTY

AND EQUIPMENT, NET

|

1,381

|

1,699

|

|||||

|

Total

assets

|

$

|

88,680

|

$

|

86,673

|

|||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

|||||||

|

CURRENT

LIABILITIES:

|

|||||||

|

Accounts

payable and accrued liabilities

|

$

|

618

|

$

|

680

|

|||

|

Total

current liabilities

|

618

|

680

|

|||||

|

|

|||||||

|

Deferred

rent

|

343

|

277

|

|||||

|

Total

liabilities

|

961

|

957

|

|||||

|

COMMITMENTS

AND CONTINGENCIES (Note 9)

|

|||||||

|

STOCKHOLDERS'

EQUITY:

|

|||||||

|

Preferred

stock, $.0001 par value; 5,000,000 shares authorized; none

issued

|

—

|

—

|

|||||

|

Common

stock, $.0001 par value; 100,000,000 shares authorized; 17,441,747

and

17,188,622 shares issued;

and 17,366,747 and 17,113,622 outstanding in 2007 and 2006, respectively |

2

|

2

|

|||||

|

Additional

paid-in capital

|

369,827

|

367,945

|

|||||

|

Accumulated

deficit

|

(282,121

|

)

|

(282,238

|

)

|

|||

|

Less

treasury stock, 75,000 shares at cost

|

(2

|

)

|

(2

|

)

|

|||

|

Accumulated

other comprehensive gain

|

13

|

9

|

|||||

|

Total

stockholders' equity

|

87,719 |

85,716

|

|||||

|

Total

liabilities and stockholders' equity

|

$

|

88,680

|

$

|

86,673

|

|||

|

2007

|

2006

|

2005

|

||||||||

|

REVENUES:

|

||||||||||

|

Total

revenues

|

—

|

—

|

—

|

|||||||

|

OPERATING

EXPENSES:

|

||||||||||

|

General

and administrative

|

3,767

|

3,530

|

3,504

|

|||||||

|

Transaction

expense

|

(13

|

)

|

1,431

|

(59

|

)

|

|||||

|

Depreciation

|

359

|

346

|

334

|

|||||||

|

Total

operating expenses

|

4,113

|

5,307

|

3,779

|

|||||||

|

OPERATING

LOSS

|

(4,113

|

)

|

(5,307

|

)

|

(3,779

|

)

|

||||

|

OTHER

EXPENSE

|

(6

|

)

|

—

|

(2

|

)

|

|||||

|

INTEREST

INCOME

|

4,239

|

4,016

|

2,490

|

|||||||

|

NET

INCOME (LOSS) BEFORE TAXES

|

120

|

(1,291

|

)

|

(1,291

|

)

|

|||||

|

INCOME

TAXES

|

3

|

—

|

—

|

|||||||

|

NET

INCOME (LOSS)

|

$

|

117

|

$

|

(1,291

|

)

|

$

|

(1,291

|

)

|

||

|

NET

INCOME (LOSS) PER SHARE

|

||||||||||

|

Basic

|

$

|

0.01

|

$

|

(0.08

|

)

|

$

|

(0.08

|

)

|

||

|

|

||||||||||

|

Diluted

|

$

|

0.01

|

$

|

(0.08

|

)

|

$

|

(0.08

|

)

|

||

|

WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING

|

||||||||||

|

Basic

|

16,658

|

16,613

|

16,329

|

|||||||

|

Diluted

|

17,051

|

16,613

|

16,329

|

|||||||

|

Accumulated

|

||||||||||||||||||||||

|

Additional

|

Other

|

|||||||||||||||||||||

|

Common

Stock

|

Paid-In

|

Accumulated

|

Treasury

Stock

|

Comprehensive

|

||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit

|

Shares

|

Amount

|

Income

(loss)

|

||||||||||||||||

|

BALANCES,

December 31, 2004

|

16,735

|

2

|

368,385

|

(279,656

|

)

|

(75

|

)

|

(2

|

)

|

(130

|

)

|

|||||||||||

|

Exercise

of stock options

|

448

|

—

|

2,594

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Issuance

of restricted shares, net of amortization

|

4

|

—

|

(275

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||

|

Net

loss

|

—

|

—

|

—

|

(1,291

|

)

|

—

|

—

|

—

|

||||||||||||||

|

Increase

in unrealized gain on marketable securities

|

—

|

—

|

—

|

—

|

—

|

—

|

42

|

|||||||||||||||

|

BALANCES,

December 31, 2005

|

17,187

|

2

|

370,704

|

(280,947

|

)

|

(75

|

)

|

(2

|

)

|

(88

|

)

|

|||||||||||

|

Exercise

of stock options

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Issuance

of restricted shares, net of amortization

|

1

|

—

|

301

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Net

loss

|

—

|

—

|

—

|

(1,291

|

)

|

—

|

—

|

—

|

||||||||||||||

|

Reclassification

of deferred compensation upon adoption of SFAS No. 123R as of January

1,

2006

|

—

|

—

|

(3,060

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||

|

Increase

in unrealized gain on marketable securities

|

—

|

—

|

—

|

—

|

—

|

—

|

97

|

|||||||||||||||

|

BALANCES,

December 31, 2006

|

17,188

|

2

|

367,945

|

(282,238

|

)

|

(75

|

)

|

(2

|

)

|

9

|

||||||||||||

|

Exercise

of stock options

|

247

|

—

|

1,438

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Issuance

of restricted shares, net of amortization

|

7

|

—

|

444

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Net

income

|

—

|

—

|

—

|

117

|

—

|

—

|

—

|

|||||||||||||||

|

Increase

in unrealized gain on marketable securities

|

—

|

—

|

—

|

—

|

—

|

—

|

4

|

|||||||||||||||

|

BALANCES,

December 31, 2007

|

17,442

|

$

|

2

|

$

|

369,827

|

$

|

(282,121

|

)

|

(75

|

)

|

$

|

(2

|

)

|

$

|

13

|

|||||||

|

Total

|

||||||||||

|

Deferred

|

Stockholders'

|

Comprehensive

|

||||||||

|

Compensation

|

Equity

|

Loss

|

||||||||

|

BALANCES,

December 31, 2004

|

(3,745

|

)

|

84,854

|

—

|

||||||

|

Exercise

of stock options

|

—

|

2,594

|

—

|

|||||||

|

Issuance

of restricted shares, net of amortization

|

685

|

410

|

—

|

|||||||

|

Net

loss

|

—

|

(1,291

|

)

|

(1,291

|

)

|

|||||

|

Increase

in unrealized gain on marketable securities

|

—

|

42

|

42

|

|||||||

|

Total

comprehensive loss

|

|

|

$

|

(1,249

|

)

|

|||||

|

BALANCES,

December 31, 2005

|

(3,060

|

)

|

86,609

|

—

|

||||||

|

Exercise

of stock options

|

—

|

—

|

—

|

|||||||

|

Issuance

of restricted shares, net of amortization

|

—

|

301

|

—

|

|||||||

|

Net

loss

|

—

|

(1,291

|

)

|

(1,291

|

)

|

|||||

|

Reclassification

of deferred compensation upon the adoption of SFAS No. 123R as

of January

1, 2006

|

3,060

|

—

|

—

|

|||||||

|

Increase

in unrealized gain on marketable securities

|

—

|

97

|

97

|

|||||||

|

Total

comprehensive loss

|

$

|

(1,194

|

)

|

|||||||

|

BALANCES,

December 31, 2006

|

—

|

85,716

|

—

|

|||||||

|

Exercise

of stock options

|

—

|

1,438

|

—

|

|||||||

|

Issuance

of restricted shares, net of amortization

|

—

|

444

|

—

|

|||||||

|

Net

income

|

—

|

117

|

117

|

|||||||

|

Increase

in unrealized gain on marketable securities

|

—

|

4

|

4

|

|||||||

|

Total

comprehensive loss

|

$

|

(1,073

|

)

|

|||||||

|

BALANCES,

December 31, 2007

|

$

|

—

|

$

|

87,719

|

||||||

|

2007

|

2006

|

2005

|

||||||||

|

OPERATING

ACTIVITIES:

|

||||||||||

|

Net

income (loss)

|

$

|

117

|

$

|

(1,291

|

)

|

$

|

(1,291

|

)

|

||

|

Adjustments

to reconcile net income (loss) to net cash used in operating

activities:

|

||||||||||

|

Depreciation

of property and equipment

|

359

|

346

|

334

|

|||||||

|

Amortization

of (discount) and premium on securities, net

|

(2,929

|

)

|

(2,405

|

)

|

(669

|

)

|

||||

|

Amortization

of equity compensation plans

|

444

|

301

|

410

|

|||||||

|

Changes

in operating assets and liabilities:

|

||||||||||

|

Decrease/(increase)

in interest receivable, prepaids and other current assets

|

419

|

(154

|

)

|

77

|

||||||

|

Decrease/(increase)

in deposits and other long-term assets

|

—

|

956

|

(1

|

)

|

||||||

|

Decrease

in accounts payable and accrued liabilities

|

(62

|

)

|

(781

|

)

|

(731

|

)

|

||||

|

Increase

in deferred rent

|

66

|

69

|

93

|

|||||||

|

Net

cash used in operating activities

|

(1,586

|

)

|

(2,959

|

)

|

(1,778

|

)

|

||||

|

INVESTING

ACTIVITIES:

|

||||||||||

|

Purchase

of marketable securities

|

(150,803

|

)

|

(161,004

|

)

|

(93,887

|

)

|

||||

|

Proceeds

from the sale and maturity of marketable securities

|

191,147

|

142,473

|

68,116

|

|||||||

|

Purchase

of property and equipment

|

(48

|

)

|

(49

|

)

|

(17

|

)

|

||||

|

Disposal

of equipment

|

7

|

—

|

—

|

|||||||

|

Increase

in transaction expenses

|

—

|

—

|

(135

|

)

|

||||||

|

Net

cash provided by (used in) investing activities

|

40,303

|

(18,580

|

)

|

(25,923

|

)

|

|||||

|

FINANCING

ACTIVITIES:

|

||||||||||

|

Proceeds

from the exercise of stock options

|

1,438

|

—

|

2,594

|

|||||||

|

Net

cash provided by financing activities

|

1,438

|

—

|

2,594

|

|||||||

|

CHANGE

IN CASH AND CASH EQUIVALENTS

|

40,155

|

(21,539

|

)

|

(25,107

|

)

|

|||||

|

CASH

AND CASH EQUIVALENTS, beginning of year

|

1,731

|

23,270

|

48,377

|

|||||||

|

CASH

AND CASH EQUIVALENTS, end of year

|

$

|

41,886

|

$

|

1,731

|

$

|

23,270

|

||||

|

SUPPLEMENTAL

DISCLOSURE:

|

||||||||||

|

(Decrease)/increase

in transaction expenses included in accounts payable and accrued

liabilities

|

$

|

—

|

$

|

(778

|

)

|

$

|

778

|

|||

|

(Decrease)/increase

in transaction expenses included in other assets

|

$

|

—

|

$

|

(913

|

)

|

$

|

913

|

|||

|

Grant

of restricted stock

|

$

|

—

|

$

|

—

|

$

|

50

|

||||

|

Cash

paid for franchise and property taxes

|

$

|

456

|

$

|

540

|

$

|

684

|

||||

|

December

31,

|

Useful

Life

|

|||||||||

|

2007

|

2006

|

(in

years)

|

||||||||

|

Computers

and equipment

|

$

|

263

|

$

|

249

|

1

- 5

|

|||||

|

Furniture

and fixtures

|

488

|

488

|

7

|

|||||||

|

Leasehold

improvements

|

1,893

|

1,893

|

8

|

|||||||

|

2,644

|

2,630

|

|||||||||

|

Less:

accumulated depreciation

|

(1,263

|

)

|

(931

|

)

|

||||||

|

Property

and equipment, net

|

$

|

1,381

|

$

|

1,699

|

||||||

|

2007

|

2006

|

||||||

|

Accounts

payable

|

$

|

17

|

$

|

335

|

|||

|

Accrued

bonuses

|

220

|

30

|

|||||

|

Accrued

professional services

|

205

|

201

|

|||||

|

Accrued

taxes

|

120

|

98

|

|||||

|

Other

|

56

|

16

|

|||||

|

$

|

618

|

$

|

680

|

||||

|

Options

Vesting Period

|

1

year

|

4

years

|

|||||

|

Dividend

Yield

|

0.00

|

%

|

0.00

|

%

|

|||

|

Expected

volatility

|

31.8

|

%

|

40.9

|

%

|

|||

|

Risk-free

interest rate

|

3.54

|

%

|

3.80

|

%

|

|||

|

Expected

life

|

5.75

years

|

6.25

years

|

|||||

|

Weighted

average fair value

|

$

|

2.22

|

$

|

2.77

|

|||

|

2005

|

||||

|

Net

loss, as reported

|

$

|

(1,291

|

)

|

|

|

Add

stock-based employee compensation expense included in reported

net loss

|

410

|

|||

|

Deduct

total stock-based employee compensation expense determined

under fair-value based method for all awards |

(3,467

|

)

|

||

|

Pro

forma net loss

|

$

|

(4,348

|

)

|

|

|

Earnings

per Share:

|

||||

|

Basic

- as reported

|

$

|

(0.08

|

)

|

|

|

Basic

- pro forma

|

$

|

(0.27

|

)

|

|

|

Diluted

- as reported

|

$

|

(0.08

|

)

|

|

|

Diluted

- pro forma

|

$

|

(0.27

|

)

|

|

|

2005

|

||||

|

Dividend

yield

|

0

|

%

|

||

|

Expected

volatility

|

57

|

%

|

||

|

Risk-free

interest rate

|

4.31

|

%

|

||

|

Expected

life

|

Four

years

|

|||

|

2007

|

2006

|

2005

|

||||||||

|

Weighted

average common shares - basic

|

16,658

|

16,613

|

16,329

|

|||||||

|

Effect

of dilutive stock options

|

148

|

112

|

316

|

|||||||

|

Effect

of dilutive restricted stock

|

245

|

205

|

502

|

|||||||

|

Total

effect of potential incremental shares

|

393

|

317

|

818

|

|||||||

|

Weighted

average common shares - diluted

|

17,051

|

16,930

|

17,147

|

|||||||

|

Net

income (loss) per share:

|

||||||||||

|

Basic

|

$

|

0.01

|

$

|

(0.08

|

)

|

$

|

(0.08

|

)

|

||

|

Diluted

|

$

|

0.01

|

$

|

(0.08

|

)

|

$

|

(0.08

|

)

|

||

|

(in

thousands)

|

2007

|

2006

|

2005

|

|||||||

|

Revenue:

|

||||||||||

|

United

States

|

$

|

—

|

$

|

—

|

$

|

—

|

||||

|

International

|

—

|

—

|

—

|

|||||||

|

Total

|

$

|

—

|

$

|

—

|

$

|

—

|

||||

|

Property

and equipment, net:

|

||||||||||

|

United

States

|

$

|

1,381

|

$

|

1,699

|

$

|

1,996

|

||||

|

Total

|

$

|

1,381

|

$

|

1,699

|

$

|

1,996

|

||||

|

YEARS

ENDED

|

||||||||||

|

DECEMBER

31,

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Pre-Tax

Income (loss):

|

||||||||||

|

Domestic

|

$

|

120

|

$

|

(1,291

|

)

|

$

|

(1,291

|

)

|

||

|

Foreign

|

—

|

—

|

—

|

|||||||

|

$

|

120

|

$

|

(1,291

|

)

|

$

|

(1,291

|

)

|

|||

|

|

YEARS

ENDED

|

|||||||||

|

DECEMBER

31,

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Current:

|

||||||||||

|

Federal

|

$

|

3

|

$

|

—

|

$

|

—

|

||||

|

State

|

—

|

—

|

—

|

|||||||

|

Foreign

|

—

|

—

|

—

|

|||||||

|

Total

current income for provision

|

$

|

3

|

$

|

—

|

$

|

—

|

||||

|

YEARS

ENDED

|

||||||||||

|

DECEMBER

31,

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Deferred:

|

||||||||||

|

Federal

|

3,850

|

(168

|

)

|

(3,122

|

)

|

|||||

|

State

|

1,218

|

350

|

7,057

|

|||||||

|

Foreign

|

—

|

—

|

—

|

|||||||

|

5,068

|

182

|

3,935

|

||||||||

|

Increase

(decrease) in valuation allowance for deferred income

taxes

|

(5,068

|

)

|

(182

|

)

|

(3,935

|

)

|

||||

|

Total

deferred income tax for provision

|

—

|

—

|

—

|

|||||||

|

Total

income tax provision

|

$

|

3

|

$

|

—

|

$

|

—

|

||||

|

2007

|

2006

|

2005

|

||||||||

|

Income

(loss) from operations

|

$

|

(5,068

|

)

|

$

|

(182

|

)

|

$

|

(3,935

|

)

|

|

|

Stockholders’

equity

|

(1

|

)

|

(38

|

)

|

34

|

|||||

|

Total

|

$ | (5,069 | ) | $ | (220 | ) | $ | (3,901 | ) | |

|

YEARS

ENDED

|

||||||||||

|

DECEMBER

31,

|

||||||||||

|

2007

|

2006

|

2005

|

||||||||

|

Computed

"expected" income tax expense (benefit)

|

34.0

|

%

|

(34.0

|

)%

|

(34.0

|

)%

|

||||

|

Increase

(decrease) in income taxes resulting from:

|

||||||||||

|

State

income taxes, net of federal income taxes

|

514.4

|

(0.5

|

)

|

(7.4

|

)

|

|||||

|

NOL

adjustments

|

152.3

|

18.3

|

376.6

|

|||||||

|

Capital

loss carryforward adjustment

|

3,506.2

|

30.3

|

—

|

|||||||

|

Non-cash

stock compensation

|

(9.5

|

)

|

—

|

(29.5

|

)

|

|||||

|

Income

tax effect attributable to foreign operations

|

—

|

—

|

—

|

|||||||

|

Other

|

8.2

|

—

|

—

|

|||||||

|

(Decrease)

increase in valuation allowance and other items

|

(4,202.8

|

)

|

(14.1

|

)

|

(305.7

|

)

|

||||

|

Income

tax expense (benefit)

|

2.8

|

%

|

—

|

%

|

—

|

%

|

||||

|

YEARS

ENDED

|

|||||||

|

DECEMBER

31,

|

|||||||

|

2007

|

2006

|

||||||

|

Deferred

income tax assets:

|

|||||||

|

Net

operating loss, capital loss amount and research & experimentation

credit carryforwards

|

$

|

84,970

|

$

|

90,209

|

|||

|

Charitable

contribution carryforward

|

4

|

4

|

|||||

|

Depreciation

|

(139

|

)

|

(241

|

)

|

|||

|

Unrealized

loss

|

(5

|

)

|

(4

|

)

|

|||

|

Non-cash

compensation

|

724

|

608

|

|||||

|

Accrued

liabilities

|

134

|

181

|

|||||

|

Reserves

for investments

|

1,728

|

1,728

|

|||||

|

Net

deferred income tax assets before valuation allowance

|

87,416

|

92,485

|

|||||

|

Valuation

allowance for deferred income tax assets

|

(87,416

|

)

|

(92,485

|

)

|

|||

|

Net

deferred income tax assets

|

$

|

—

|

$

|

—

|

|||

|

Net

Operating Loss

|

Capital

Loss

|

||||||

|

Expiration

Dates

December

31

|

Amount

(000’s)

|

Amount

(000’s)

|

|||||

|

2007

|

$

|

—

|

$

|

0

|

|||

|

2008

|

—

|

1,599

|

|||||

|

2009

|

1,900

|

||||||

|

2010

|

7,417

|

||||||

|

2011

|

7,520

|

||||||

|

2012

|

5,157

|

||||||

|

2020

|

29,533

|

||||||

|

2021

|

50,430

|

||||||

|

2022

|

115,000

|

||||||

|

2023

|

5,712

|

||||||

|

2024

|

3,566

|

||||||

|

2025

|

1,707

|

||||||

|

2026

|

476

|

||||||

|

Total

|

228,418

|

1,599

|

|||||

|

Section

382 limitation

|

(5,363

|

)

|

—

|

||||

|

After

Limitations

|

$

|

223,055

|

$

|

1,599

|

|||

|

*

Subject to compliance with Section 382 of the Internal Revenue

Code.

|

|||||||

|

Options

Vesting Period

|

1

year

|

4

years

|

|||||

|

Dividend

Yield

|

0.00

|

%

|

0.00

|

%

|

|||

|

Expected

volatility

|

31.8

|

%

|

40.9

|

%

|

|||

|

Risk-free

interest rate

|

3.54

|

%

|

3.80

|

%

|

|||

|

Expected

life

|

5.75

years

|

6.25

years

|

|||||

|

Weighted

average fair value

|

$

|

2.22

|

$

|

2.77

|

|||

|

Weighted

|

||||||||||

|

Range

of

|

Average

|

|||||||||

|

Exercise

|

Exercise

|

|||||||||

|

Shares

|

Prices

|

Price

|

||||||||

|

December

31, 2004

|

1,961,617

|

|

$4.83

- $10.00

|

$

|

6.93

|

|||||

|

Granted

|

175,000

|

|

$7.40

- $ 8.50

|

$

|

8.16

|

|||||

|

Forfeited

|

—

|

|||||||||

|

Expired

|

(7,500

|

)

|

|

$7.63

|

$

|

7.63

|

||||

|

Exercised

|

(447,867

|

)

|

|

$4.83

- $7.00

|

$

|

5.79

|

||||

|

December

31, 2005

|

1,681,250

|

|

$5.35

- $10.00

|

$

|

7.36

|

|||||

|

Granted

|

—

|

|||||||||

|

Forfeited

|

—

|

|||||||||

|

Expired

|

(7,500

|

)

|

|

$5.41

|

$

|

5.41

|

||||

|

Exercised

|

—

|

|||||||||

|

December

31, 2006

|

1,673,750

|

|

$5.35

- $10.00

|

$

|

7.36

|

|||||

|

Granted

|

430,000

|

|

$5.98

|

$

|

5.98

|

|||||

|

Forfeited

|

(7,757

|

)

|

|

$7.40

- $8.60

|

$

|

8.17

|

||||

|

Expired

|

—

|

|||||||||

|

Exercised

|

(247,243

|

)

|

|

$5.35

- $8.60

|

$

|

5.81

|

||||

|

December

31, 2007

|

1,848,750

|

|

$5.35

- $10.00

|

$

|

7.24

|

|||||

|

Vested

and exercisable at December 31, 2007

|

1,493,750

|

$

|

7.54

|

|||||||

|

Vested

and exercisable at December 31, 2006

|

1,673,750

|

$

|

7.36

|

|||||||

|

Vested

and exercisable at December 31, 2005

|

1,681,250

|

$

|

7.36

|

|||||||

|

Outstanding

|

Exercisable

|

|||||||||||||||

|

Weighted

|

||||||||||||||||

|

Number

|

Weighted

|

Average

|

Number

|

Weighted

|

||||||||||||

|

Exercise

|

of

Shares

|

Average

|

Remaining

|

of

Shares

|

Average

|

|||||||||||

|

Price

|

Outstanding

at

|

Exercise

|

Contractual

|

Exercisable

at

|

Exercise

|

|||||||||||

|

Range

|

December

31, 2007

|

Price

|

Life

(Years)

|

December

31, 2007

|

Price

|

|||||||||||

|

$

5.35 - $ 7.81

|

1,298,750

|

$

|

6.27

|

6.4

|

943,750

|

$

|

6.37

|

|||||||||

|

$

7.82 - $10.00

|

550,000

|

$

|

9.55

|

5.8

|

550,000

|

$

|

9.55

|

|||||||||

|

1,848,750

|

$

|

7.24

|

6.2

|

1,493,750

|

$

|

7.54

|

||||||||||

|

Gross

Rental

|

Sub-Lease

|

||||||

|

Obligations

|

Income

|

||||||

|

Year

ending December 31,

|

|||||||

|

2008

|

420

|

105

|

|||||

|

2009

|

426

|

106

|

|||||

|

2010

|

451

|

113

|

|||||

|

2011

|

1,128

|

282

|

|||||

|

2012

|

—

|

—

|

|||||

|

Thereafter

|

—

|

—

|

|||||

|

Total

|

$

|

2,425

|

$

|

606

|

|||

| · |

pertain

to the maintenance of records that, in reasonable detail, accurately

and

fairly reflect the transactions and dispositions of the assets of

the

Company;

|

| · |

provide

reasonable assurance that transactions are recorded as necessary

to permit

preparation of financial statements in accordance with GAAP, and

that

receipts and expenditures of the Company are being made only in accordance

with authorizations of management and directors of the Company; and

|

| · |

provide

reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use or disposition of the Company's assets

that

could have a material effect on the financial statements.

|

| (a) |

Financial

Statements

|

| (1) |

The

following financial statements are filed with this report on the

following

pages indicated:

|

|

Page

|

||

|

25

|

||

|

26

|

||

|

27

|

||

|

28

|

||

|

30

|

||

|

31

|

| (2) |

The

following additional financial statement schedule and report of

independent registered public accounting firm

are furnished herewith pursuant to the requirements of Form

10-K:

|

| (3) |

The

following Exhibits are hereby filed as part of this Annual Report

on Form

10-K:

|

|

Exhibit

Number

|

Exhibit |

| 3.1 |

Amended

and Restated Certificate of Incorporation of the Company (incorporated

herein by reference to Exhibit 3.3 of the Company's

Form S-1 Registration Statement filed with the Securities and Exchange

Commission on April 6, 1998 (File No. 333-

46685)).

|

| 3.2 |

Amendment

to Amended and Restated Certificate of Incorporation (incorporated

herein

by reference to Exhibit 4.1 of the Company's

10-Q filed with the Securities and Exchange Commission on August

14,

2000).

|

|

3.3

|

Amended

and Restated Certificate of Incorporation of the Company (incorporated

herein by reference to Appendix C of the Company’s Definitive Proxy

Statement filed with the Securities and Exchange Commission on November

6,

2002).

|

| 3.4 |

Amendment

to Amended and Restated Certificate of Incorporation of the Company

(incorporated herein by reference to Exhibit

3.1 of the Company's Current Report on Form 8-K, filed with the Securities

and Exchange Commission on July 31, 2003).

|

|

3.5

|

Amended

and Restated Bylaws of the Company (incorporated herein by reference

to

Appendix D of the Company's Definitive Proxy Statement filed with

the

Securities and Exchange Commission on November 6, 2002).

|

| 3.6 |

Amendment

No. 1 to the Amended and Restated Bylaws of the Company. (incorporated

herein by reference to Exhibit 3.4 of the

Company's Annual Report on Form 10-K, filed with the Securities and

Exchange Commission on March 31, 2003).

|

|

3.7

|

Form

of Certificate of Designation of Series A Junior Participating Preferred

Stock (incorporated herein by reference to Exhibit 3.1 of the Company's

Form 8-K, filed with the Securities and Exchange Commission on February

13, 2008).

|

| 4.1 |

See

Exhibits 3.1, 3.2, 3.3, 3.4 and 3.5 for provisions of the Amended

and

Restated Certificate of Incorporation and Amended and

Restated Bylaws of the Company defining rights of the holders of

Common

Stock of the Company.

|

| 4.2 |

Specimen

Stock Certificate (incorporated herein by reference to Exhibit 4.2

of the

Company's Registration Statement on Form

S-1 filed with the Securities and Exchange Commission on May 26,

1998

(File No. 333-46685)).

|

| 4.3 |

Restricted

Stock Agreement, dated as of April 11, 2003, between the Company

and

Warren B. Kanders (incorporated herein by

reference to Exhibit 4.1 of the Company's Form 10-Q filed with the

Securities and Exchange Commission on May 15, 2003).

*

|

| 4.4 |

Rights

Agreement, dated as of February 12, 2008, by and between Clarus

Corporation and American Stock Transfer & Trust Company (incorporated

herein by reference to Exhibit 4.2 of the Company’s Form 8-K filed with

the Securities and Exchange Commission on February 13,

2008).

|

|

4.5

|

Form

of Rights Certificate (incorporated herein by reference to Exhibit

4.1 of

the Company’s Form 8-K filed with the Securities and Exchange Commission

on February 13, 2008).

|

| 10.1 |

Asset

Purchase Agreement, dated as of October 17, 2002, between Epicor

Software

Corporation and the Company (incorporated

herein reference to Exhibit 2.1 of the Company's Form 8-K filed with

the

Securities and Exchange Commission on

October 18, 2002).

|

| 10.2 |

Bill

of Sale and Assumption Agreement, dated as of December 6, 2002, between

Epicor Software Corporation and the Company

(incorporated herein by reference to Exhibit 2.2 of the Company's

Form 8-K

filed with the Securities and Exchange Commission

on October 18, 2002).

|

| 10.3 |

Trademark

Assignment, dated as of December 6, 2002, by the Company in favor

of

Epicor Software Corporation, (incorporated

herein by reference to Exhibit 2.3 of the Company's Form 8-K filed

with

the Securities and Exchange Commission

on October 18, 2002).

|

| 10.4 |

Patent

Assignment, dated as of December 6, 2002, between Epicor Software

Corporation and the Company (incorporated herein

by reference to Exhibit 2.4 of the Company's Form 8-K filed with

the

Securities and Exchange Commission on October

18, 2002).

|

| 10.5 |

Noncompetition

Agreement, dated as of December 6, 2002, between Epicor Software

Corporation and the Company (incorporated

herein by reference to Exhibit 2.5 of the Company's Form 8-K filed

with

the Securities and Exchange Commission

on October 18, 2002).

|

| 10.6 |

Transition

Services Agreement, dated as of December 6, 2002, between Epicor

Software

Corporation and the Company (incorporated

herein by reference to Exhibit 2.7 of the Company's Form 8-K filed

with

the Securities and Exchange Commission

on October 18, 2002).

|

| 10.7 |

Form

of Indemnification Agreement for Directors and Executive Officers

of the

Company (incorporated herein by reference to

Exhibit 10.1 of the Company's Form 8-K filed with the Securities

and

Exchange Commission on December 23, 2002).

|

| 10.8 |

Employment

Agreement, dated as of December 6, 2002, between the Company and

Warren B.

Kanders (incorporated herein by

reference to Exhibit 10.2 of the Company's Form 8-K filed with the

Securities and Exchange Commission on December 23,

2002).*

|

| 10.9 |

Amended

and Restated Stock Incentive Plan (incorporated herein by reference

to

Exhibit 10.2 of the Company's Form 10-Q filed

with the Securities and Exchange Commission on August 14, 2000).

*

|

| 10.10 |

Form

of Nonqualified Stock Option Agreement (incorporated herein by reference

to Exhibit 10.5 of the Company's Form 10- Q

filed with the Securities and Exchange Commission on August 14, 2000).

*

|

|

10.11

|

Lease,

dated as of September 23, 2003, between Reckson Operating Partnership,

L.P., the Company and Kanders & Company, Inc. (incorporated herein by

reference to Exhibit 10.1 of the Company's 10-Q filed with the Securities

and Exchange Commission on November 12, 2003).

|

|

10.12

|

Transportation

Services Agreement, dated as of December 18, 2003, between Kanders

Aviation, LLC and the Company (incorporated herein by reference to

Exhibit

10.23 of the Company's 10-K filed with the Securities and Exchange

Commission on March 11, 2004).

|

| 10.13 |

Clarus

Corporation 2005 Stock Incentive Plan (incorporated herein by reference

to

Appendix A of the Company's Definitive Proxy Statement filed with

the

Securities and Exchange Commission on May 2, 2005).

*

|

| 10.14 |

Form

of Stock Option Agreement for the Clarus Corporation 2005 Stock Incentive

Plan (incorporated herein by reference to Exhibit

10.1 of the Company's Form 10-Q filed with the Securities and Exchange

Commission on November 11, 2005). *

|

| 10.15 |

Amendment

to the form of Stock Option Agreement for the Clarus Corporation

2005

Stock Incentive Plan (incorporated herein

by reference to Exhibit 10.1 of the Company's Form 8-K filed with

the

Securities and Exchange Commission on January

6, 2006). *

|

|

10.16

|

Stock

Option Agreement, dated December 23, 2002, between the Company and

Warren

B. Kanders (incorporated herein by reference to Exhibit 4.6 of the

Company's Registration Statement Form S-8 filed with the Securities

and

Exchange Commission on August 18, 2005).

*

|

|

10.17

|

Extension

Agreement, dated as of May 1, 2006, to the Employment Agreement,

dated as

of December 6, 2002, between the Company and Warren B. Kanders

(incorporated herein by reference to Exhibit 10.2 of the Company’s Form

8-K filed with the Securities and Exchange Commission on May 4,

2006).*

|

|

10.18

|

Resignation

and Severance Agreement and General Release, dated as of December

11,

2006, between the Company and Nigel P. Ekern (incorporated herein

by

reference to Exhibit 10.1 of the Company’s Form 8-K filed with the

Securities and Exchange Commission on December 12,

2006).*

|

| 23.1 |

Consent

of Independent Registered Public Accounting

Firm.

|

| 31.1 |

Certification

of Principal Executive Officer, as required by Rule 13a-14(a) of

the

Securities Exchange Act of 1934. **

|

| 31.2 |

Certification

of Principal Financial Officer, as required by Rule 13a-14(a) of

the

Securities Exchange Act of 1934. **

|

| 32.1 |

Certification

of Principal Executive Officer, as required by Rule 13a-14(b) of

the

Securities Exchange Act of 1934. **

|

| 32.2 |

Certification

of Principal Financial Officer, as required by Rule 13a-14(b) of

the

Securities Exchange Act of 1934. **

|

| * |

Management

contract or compensatory plan or arrangement.

|

| ** |

Filed

herewith.

|

|

Signature

|

Title

|

Date

|

||

|

/s/

Warren B. Kanders

|

Executive

Chairman of the Board of Directors

|

March

7, 2008

|

||

|

Warren

B. Kanders

|

(principal

executive officer)

|

|||

|

/s/

Philip A. Baratelli

|

Chief

Financial Officer

|

March

7, 2008

|

||

|

Philip

A. Baratelli

|

(principal

financial officer)

|

|||

|

/s/

Donald L. House

|

Director

|

March

7, 2008

|

||

|

Donald

L. House

|

||||

|

/s/

Burtt R. Ehrlich

|

Director

|

March

7, 2008

|

||

|

Burtt

R. Ehrlich

|

||||

|

/s/

Nicholas Sokolow

|

Director

|

March

7, 2008

|

||

|

Nicholas

Sokolow

|

|

Charged

|

|||||||||||||

|

Balance

at

|

(Credited)

to

|

Balance

at

|

|||||||||||

|

Beginning

of

|

Costs

and

|

End

of

|

|||||||||||

|

Period

|

Expenses

|

Deductions

(a)

|

Period

|

||||||||||

|

Valuation

Allowance for Deferred Income Tax Assets

|

|||||||||||||

|

2005

|

$

|

96,606,000

|

$

|

(3,901,000

|

)

|

$

|

—

|

$

|

92,705,000

|

||||

|

2006

|

92,705,000

|

(220,000

|

)

|

—

|

92,485,000

|

||||||||

|

2007

|

$

|

92,485,000

|

$

|

(5,069,000

|

)

|

$

|

—

|

$

|

87,416,000

|

||||

|

Restructuring

Accruals

|

|||||||||||||

|

2005

|

$

|

73,000

|

—

|

$

|

56,000

|

$

|

17,000

|

||||||

|

2006

|

$

|

17,000

|

—

|

$

|

17,000

|

—

|

|||||||

| (a) |

Deductions

related to restructuring and related accruals represent cash payments.

|

| 31.1 |

Certification

of Principal Executive Officer, as required by Rule 13a-14(a) of

the

Securities Exchange Act of 1934.

|

| 31.2 |

Certification

of Principal Financial Officer, as required by Rule 13a-14(a) of

the

Securities Exchange Act of 1934.

|

| 32.1 |

Certification

of Principal Executive Officer, as required by Rule 13a-14(b) of