|

Delaware

|

58-1972600

|

|

(State

of Incorporation)

|

(I.R.S.

Employer Identification No.)

|

|

PAGE

|

||||

|

PART

I

|

||||

|

ITEM

1.

|

BUSINESS

|

1

|

||

|

FORWARD-LOOKING

STATEMENTS

|

1

|

|||

|

OVERVIEW

|

1

|

|||

|

BUSINESS

|

1

|

|||

|

PRIOR

BUSINESS

|

2

|

|||

|

EMPLOYEES

|

3

|

|||

|

AVAILABLE

INFORMATION

|

3

|

|||

|

ITEM

1A.

|

RISK

FACTORS

|

4

|

||

|

ITEM

1B.

|

UNRESOLVED

STAFF COMMENTS

|

10

|

||

|

ITEM

2.

|

PROPERTIES

|

10

|

||

|

ITEM

3.

|

LEGAL

PROCEEDINGS

|

10

|

||

|

ITEM

4.

|

SUBMISSION

OF MATTERS TO A VOTE OF SECURITY HOLDERS

|

10

|

||

|

PART

II

|

||||

|

ITEM

5.

|

MARKET

FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY

SECURITIES

|

11

|

||

|

ITEM

6.

|

SELECTED

FINANCIAL DATA

|

14

|

||

|

ITEM

7.

|

MANAGEMENT'S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

15

|

||

|

ITEM

7A.

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

22

|

||

|

ITEM

8.

|

FINANCIAL

STATEMENTS AND SUPPLEMENTAL DATA

|

23

|

||

|

ITEM

9.

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

44

|

||

|

ITEM

9A.

|

CONTROLS

AND PROCEDURES

|

44

|

||

|

ITEM

9B

|

OTHER

INFORMATION

|

44

|

||

|

PART

III

|

||||

|

ITEM

10.

|

DIRECTORS

AND EXECUTIVE OFFICERS OF THE REGISTRANT

|

45

|

||

|

ITEM

11.

|

EXECUTIVE

COMPENSATION

|

45

|

||

|

ITEM

12.

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

45

|

||

|

ITEM

13.

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

45

|

||

|

ITEM

14.

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

45

|

||

|

PART

IV

|

||||

|

ITEM

15.

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES

|

46

|

||

|

SIGNATURES

|

49

|

|||

|

EXHIBIT

INDEX

|

52

|

|||

|

High

|

Low

|

|||||||

|

Calendar

Year 2009

|

||||||||

|

First

Quarter (through February 24, 2009)

|

$ | 4.34 | $ | 4.03 | ||||

|

Year

ended December 31, 2008

|

||||||||

|

First

Quarter

|

$ | 6.47 | $ | 5.60 | ||||

|

Second

Quarter

|

$ | 6.42 | $ | 5.55 | ||||

|

Third

Quarter

|

$ | 5.85 | $ | 5.01 | ||||

|

Fourth

Quarter

|

$ | 5.20 | $ | 4.02 | ||||

|

Year

ended December 31, 2007

|

||||||||

|

First

Quarter

|

$ | 8.20 | $ | 7.05 | ||||

|

Second

Quarter

|

$ | 9.80 | $ | 8.05 | ||||

|

Third

Quarter

|

$ | 9.85 | $ | 6.75 | ||||

|

Fourth

Quarter

|

$ | 7.30 | $ | 5.73 | ||||

|

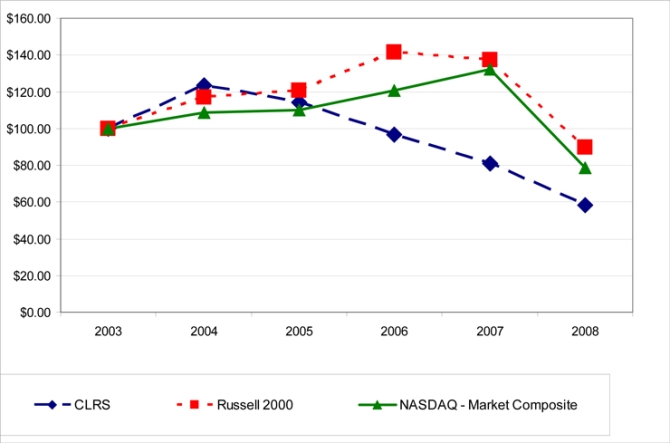

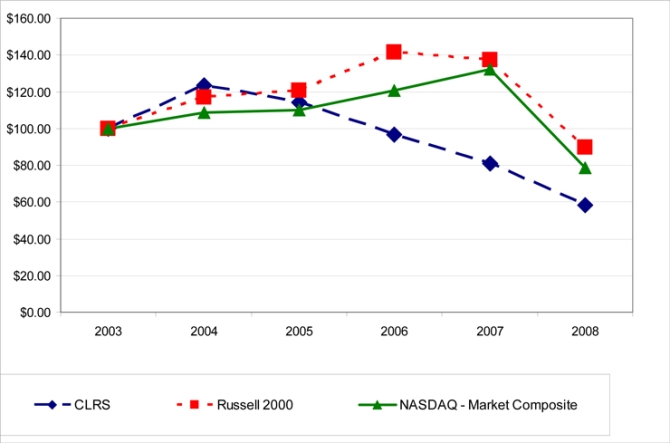

12/31/03

|

12/31/04

|

12/31/05

|

12/31/06

|

12/31/07

|

12/31/08

|

|||||||||||||||||||

|

CLARUS

CORPORATION

|

$ | 100.00 | $ | 123.29 | $ | 114.38 | $ | 96.58 | $ | 80.82 | $ | 58.22 | ||||||||||||

|

NASDAQ

NATIONAL MARKET

COMPOSITE

|

$ | 100.00 | $ | 108.59 | $ | 110.09 | $ | 120.56 | $ | 132.39 | $ | 78.72 | ||||||||||||

|

THE

RUSSELL 2000 INDEX

|

$ | 100.00 | $ | 117.00 | $ | 120.88 | $ | 141.43 | $ | 137.55 | $ | 89.68 | ||||||||||||

|

Plan Category

|

(A)

Number of

securities to be

issued upon

exercise of

outstanding

options, warrants

and rights

|

(B)

Weighted-

Average exercise

price of

outstanding

options, warrants

and rights

|

(C)

Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities reflected in

column (A))

|

|||||||||

|

Equity

compensation plans approved by security holders (1)

|

1,308,750 | $ | 5.25 | 4,406,517 | ||||||||

|

Equity

compensation plans not approved by security holders (2) (3)

(4)

|

1,100,000 | $ | 7.83 | — | ||||||||

|

Total

|

2,408,750 | $ | 6.42 | 4,406,517 | ||||||||

|

Years ended December 31,

|

||||||||||||||||||||

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||||||||

|

(in

thousands, except per share data)

|

||||||||||||||||||||

|

Statement of Operations

Data:

|

||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||

|

License

fees

|

$ | — | $ | — | $ | — | $ | — | $ | 1,106 | ||||||||||

|

Total

Revenues

|

— | — | — | — | 1,106 | |||||||||||||||

|

Operating

expenses:

|

||||||||||||||||||||

|

General

and administrative

|

4,517 | 3,767 | 3,530 | 3,504 | 3,395 | |||||||||||||||

|

Transaction

expense

|

— | (13 | ) | 1,431 | (59 | ) | 1,636 | |||||||||||||

|

Depreciation

|

356 | 359 | 346 | 334 | 186 | |||||||||||||||

|

Total

Operating Expenses

|

4,873 | 4,113 | 5,307 | 3,779 | 5,217 | |||||||||||||||

|

Operating

Loss

|

(4,873 | ) | (4,113 | ) | (5,307 | ) | (3,779 | ) | (4,111 | ) | ||||||||||

|

Other

(expense) income

|

(2 | ) | (6 | ) | — | (2 | ) | 19 | ||||||||||||

|

Interest

income

|

2,473 | 4,239 | 4,016 | 2,490 | 1,203 | |||||||||||||||

|

Net

(Loss) Income Before Income Tax

|

$ | (2,402 | ) | $ | 120 | $ | (1,291 | ) | $ | (1,291 | ) | $ | (2,889 | ) | ||||||

|

Income

tax

|

— | 3 | — | — | — | |||||||||||||||

|

Net

(Loss) Income

|

$ | (2,402 | ) | $ | 117 | $ | (1,291 | ) | $ | (1,291 | ) | $ | (2,889 | ) | ||||||

|

(Loss)

Income Per Share

|

||||||||||||||||||||

|

Basic

|

$ | (0.14 | ) | $ | 0.01 | $ | (0.08 | ) | $ | (0.08 | ) | $ | (0.18 | ) | ||||||

|

Diluted

|

$ | (0.14 | ) | $ | 0.01 | $ | (0.08 | ) | $ | (0.08 | ) | $ | (0.18 | ) | ||||||

|

Weighted

Average Common Shares Outstanding

|

||||||||||||||||||||

|

Basic

|

16,867 | 16,658 | 16,613 | 16,329 | 16,092 | |||||||||||||||

|

Diluted

|

16,867 | 17,051 | 16,613 | 16,329 | 16,092 | |||||||||||||||

|

Balance Sheet Data:

|

As of December 31,

|

|||||||||||||||||||

|

2008

|

2007

|

2006

|

2005

|

2004

|

||||||||||||||||

|

Cash

and cash equivalents

|

$ | 19,342 | $ | 41,886 | $ | 1,731 | $ | 23,270 | $ | 48,377 | ||||||||||

|

Marketable

securities

|

$ | 66,670 | $ | 45,223 | $ | 82,634 | $ | 61,601 | $ | 35,119 | ||||||||||

| $ | 87,177 | $ | 88,680 | $ | 86,673 | $ | 88,278 | $ | 86,437 | |||||||||||

|

Total

stockholders' equity

|

$ | 86,384 | $ | 87,719 | $ | 85,716 | $ | 86,609 | $ | 84,854 | ||||||||||

|

Options Vesting Period

|

1 year

|

|||

|

Dividend

Yield

|

0.00 | % | ||

|

Expected

volatility

|

28.95 | % | ||

|

Risk-free

interest rate

|

2.98 | % | ||

|

Expected

life

|

5.31 years

|

|||

|

Weighted

average fair value

|

$ | 1.61 | ||

|

Options Vesting Period

|

1 year

|

4 years

|

||||||

|

Dividend

Yield

|

0.00 | % | 0.00 | % | ||||

|

Expected

volatility

|

31.8 | % | 40.9 | % | ||||

|

Risk-free

interest rate

|

3.54 | % | 3.80 | % | ||||

|

Expected

life

|

5.75 years

|

6.25 years

|

||||||

|

Weighted

average fair value

|

$ | 2.22 | $ | 2.77 | ||||

|

Net Operating

Loss

|

||||

|

Expiration Dates

December 31

|

Amount

(000’s)

|

|||

|

2009

|

$ | 1,900 | ||

|

2010

|

7,417 | |||

|

2011

|

7,520 | |||

|

2012

|

5,157 | |||

|

2020

|

29,533 | |||

|

2021

|

50,430 | |||

|

2022

|

115,000 | |||

|

2023

|

5,712 | |||

|

2024

|

3,566 | |||

|

2025

|

1,707 | |||

|

2026

|

476 | |||

|

2028

|

1,372 | |||

|

Total

|

229,790 | |||

|

Section

382 limitation

|

(4,428 | ) | ||

|

After

Limitations

|

$ | 225,362 | ||

|

Contractual Obligations

|

||||||||||||||||||||

|

(in thousands)

|

Payment Due By Period

|

|||||||||||||||||||

|

Less Than

|

More Than

|

|||||||||||||||||||

|

Total

|

1 Year

|

1-3 Years

|

3-5 Years

|

5 Years

|

||||||||||||||||

|

Operating

Lease Obligations

|

$ | 2,005 | $ | 426 | $ | 1,579 | $ | — | $ | — | ||||||||||

|

Total

|

$ | 2,005 | $ | 426 | $ | 1,579 | $ | — | $ | — | ||||||||||

|

2008

|

||||||||||||||||

|

First

|

Second

|

Third

|

Fourth

|

|||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

|||||||||||||

|

Revenues

|

$ | — | $ | — | $ | — | $ | — | ||||||||

|

Operating

loss

|

$ | (1,239 | ) | $ | (1,342 | ) | $ | (1,249 | ) | $ | (1,043 | ) | ||||

|

Net

(loss) income before taxes

|

$ | (417 | ) | $ | (783 | ) | $ | (715 | ) | $ | (487 | ) | ||||

|

Net

(loss) income

|

$ | (417 | ) | $ | (783 | ) | $ | (715 | ) | $ | (487 | ) | ||||

|

Net

(loss) income per share:

|

||||||||||||||||

|

Basic

|

$ | (0.02 | ) | $ | (0.05 | ) | $ | (0.04 | ) | $ | (0.03 | ) | ||||

|

Diluted

|

$ | (0.02 | ) | $ | (0.05 | ) | $ | (0.04 | ) | $ | (0.03 | ) | ||||

|

2007

|

||||||||||||||||

|

First

|

Second

|

Third

|

Fourth

|

|||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

|||||||||||||

|

Revenues

|

$ | — | $ | — | $ | — | $ | — | ||||||||

|

Operating

loss

|

$ | ( 874 | ) | $ | ( 998 | ) | $ | (1,050 | ) | $ | (1,191 | ) | ||||

|

Net

income (loss) before taxes

|

$ | 202 | $ | 81 | $ | 36 | $ | (199 | ) | |||||||

|

Net

income (loss)

|

$ | 202 | $ | 81 | $ | 36 | $ | (202 | ) | |||||||

|

Net

income (loss) per share:

|

||||||||||||||||

|

Basic

|

$ | 0.01 | $ | 0.00 | $ | 0.00 | $ | (0.01 | ) | |||||||

|

Diluted

|

$ | 0.01 | $ | 0.00 | $ | 0.00 | $ | (0.01 | ) | |||||||

|

Page

|

||

|

Report

of Independent Registered Public Accounting Firm on Consolidated Financial

Statements and Internal Control Over Financial Reporting

|

24

|

|

|

Consolidated

Balance Sheets -December 31, 2008 and 2007

|

25

|

|

|

Consolidated

Statements of Operations -Years Ended December 31, 2008, 2007 and

2006

|

26

|

|

|

Consolidated

Statements of Stockholders' Equity and Comprehensive Loss -Years Ended

December 31, 2008, 2007 and 2006

|

27

|

|

|

Consolidated

Statements of Cash Flows -Years Ended December 31, 2008, 2007 and

2006

|

29

|

|

|

Notes

to Consolidated Financial Statements

|

30

|

|

/s/ KPMG LLP

|

|

|

Stamford,

Connecticut

|

|

|

March

3, 2009

|

|

|

2008

|

2007

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT

ASSETS:

|

||||||||

|

Cash

and cash equivalents

|

$ | 19,342 | $ | 41,886 | ||||

|

Marketable

securities

|

66,670 | 45,223 | ||||||

|

Interest

receivable

|

24 | 15 | ||||||

|

Prepaids

and other current assets

|

109 | 175 | ||||||

|

Total

current assets

|

86,145 | 87,299 | ||||||

|

PROPERTY

AND EQUIPMENT, NET

|

1,032 | 1,381 | ||||||

|

Total

assets

|

$ | 87,177 | $ | 88,680 | ||||

|

LIABILITIES

AND STOCKHOLDERS' EQUITY

|

||||||||

|

CURRENT

LIABILITIES:

|

||||||||

|

Accounts

payable and accrued liabilities

|

$ | 383 | $ | 618 | ||||

|

Total

current liabilities

|

383 | 618 | ||||||

|

Deferred

rent

|

410 | 343 | ||||||

|

Total

liabilities

|

793 | 961 | ||||||

|

COMMITMENTS

AND CONTINGENCIES (Note 7)

|

||||||||

|

STOCKHOLDERS'

EQUITY:

|

||||||||

|

Preferred

stock, $.0001 par value; 5,000,000 shares authorized; none

issued

|

— | — | ||||||

|

Common

stock, $.0001 par value; 100,000,000 shares authorized;

|

||||||||

|

17,441,747

and 17,441,747 shares issued; and 17,366,747 and

17,366,747

|

||||||||

|

outstanding

in 2008 and 2007, respectively

|

2 | 2 | ||||||

|

Additional

paid-in capital

|

370,504 | 369,827 | ||||||

|

Accumulated

deficit

|

(284,523 | ) | (282,121 | ) | ||||

|

Less

treasury stock, 75,000 shares at cost

|

(2 | ) | (2 | ) | ||||

|

Accumulated

other comprehensive income

|

403 | 13 | ||||||

|

Total

stockholders' equity

|

86,384 | 87,719 | ||||||

|

Total

liabilities and stockholders' equity

|

$ | 87,177 | $ | 88,680 | ||||

|

2008

|

2007

|

2006

|

||||||||||

|

REVENUES:

|

||||||||||||

|

Total

revenues

|

$ | — | $ | — | $ | — | ||||||

|

OPERATING

EXPENSES:

|

||||||||||||

|

General

and administrative

|

4,517 | 3,767 | 3,530 | |||||||||

|

Transaction

expense

|

— | (13 | ) | 1,431 | ||||||||

|

Depreciation

|

356 | 359 | 346 | |||||||||

|

Total

operating expenses

|

4,873 | 4,113 | 5,307 | |||||||||

|

OPERATING

LOSS

|

(4,873 | ) | (4,113 | ) | (5,307 | ) | ||||||

|

OTHER

EXPENSE

|

(2 | ) | (6 | ) | — | |||||||

|

INTEREST

INCOME

|

2,473 | 4,239 | 4,016 | |||||||||

|

NET

(LOSS) INCOME BEFORE TAXES

|

(2,402 | ) | 120 | (1,291 | ) | |||||||

|

INCOME

TAXES

|

— | 3 | — | |||||||||

|

NET

(LOSS) INCOME

|

$ | (2,402 | ) | $ | 117 | $ | (1,291 | ) | ||||

|

NET

(LOSS) INCOME PER SHARE

|

||||||||||||

|

Basic

|

$ | (0.14 | ) | $ | 0.01 | $ | (0.08 | ) | ||||

|

Diluted

|

$ | (0.14 | ) | $ | 0.01 | $ | (0.08 | ) | ||||

|

WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING

|

||||||||||||

|

Basic

|

16,867 | 16,658 | 16,613 | |||||||||

|

Diluted

|

16,867 | 17,051 | 16,613 | |||||||||

|

Accumulated

|

||||||||||||||||||||||||||||

|

Additional

|

Treasury

|

Other

|

||||||||||||||||||||||||||

|

Common Stock

|

Paid-In

|

Accumulated

|

Stock

|

Comprehensive

|

||||||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit

|

Shares

|

Amount

|

Income (loss)

|

||||||||||||||||||||||

|

BALANCES,

December 31, 2005

|

17,187 | $ | 2 | $ | 370,704 | $ | (280,947 | ) | (75 | ) | $ | (2 | ) | $ | (88 | ) | ||||||||||||

|

Exercise

of stock options

|

— | — | — | — | — | — | — | |||||||||||||||||||||

|

Issuance

of restricted shares, net of amortization

|

1 | — | 301 | — | — | — | — | |||||||||||||||||||||

|

Net

loss

|

— | — | — | (1,291 | ) | — | — | — | ||||||||||||||||||||

|

Reclassification

of deferred compensation upon adoption of SFAS No. 123R as of

January 1, 2006

|

— | — | (3,060 | ) | — | — | — | — | ||||||||||||||||||||

|

Increase

in unrealized gain on marketable securities

|

— | — | — | — | — | — | 97 | |||||||||||||||||||||

|

BALANCES,

December 31, 2006

|

17,188 | 2 | 367,945 | (282,238 | ) | (75 | ) | (2 | ) | 9 | ||||||||||||||||||

|

Exercise

of stock options

|

247 | — | 1,438 | — | — | — | — | |||||||||||||||||||||

|

Issuance

of restricted shares, net of amortization

|

7 | — | 444 | — | — | — | — | |||||||||||||||||||||

|

Net

income

|

— | — | — | 117 | — | — | — | |||||||||||||||||||||

|

Increase

in unrealized gain on marketable securities

|

— | — | — | — | — | — | 4 | |||||||||||||||||||||

|

BALANCES,

December 31, 2007

|

17,442 | 2 | 369,827 | (282,121 | ) | (75 | ) | (2 | ) | 13 | ||||||||||||||||||

|

Exercise

of stock options

|

— | — | — | — | — | — | — | |||||||||||||||||||||

|

Equity

compensation

|

— | — | 677 | — | — | — | — | |||||||||||||||||||||

|

Net

loss

|

— | — | — | (2,402 | ) | — | — | — | ||||||||||||||||||||

|

Increase

in unrealized gain on marketable securities

|

— | — | — | — | — | — | 390 | |||||||||||||||||||||

|

BALANCES,

December 31, 2008

|

17,442 | $ | 2 | $ | 370,504 | $ | (284,523 | ) | (75 | ) | $ | (2 | ) | $ | 403 | |||||||||||||

|

Deferred

|

Total

Stockholders'

|

Comprehensive

|

||||||||||

|

Compensation

|

Equity

|

Loss

|

||||||||||

|

BALANCES,

December 31, 2005

|

$ | (3,060 | ) | $ | 86,609 | $ | — | |||||

|

Exercise

of stock options

|

— | — | — | |||||||||

|

Issuance

of restricted shares, net of amortization

|

— | 301 | — | |||||||||

|

Net

loss

|

— | (1,291 | ) | (1,291 | ) | |||||||

|

Reclassification

of deferred compensation upon the adoption of SFAS No. 123R as of January

1, 2006

|

3,060 | — | — | |||||||||

|

Increase

in unrealized gain on marketable securities

|

— | 97 | 97 | |||||||||

|

Total

comprehensive loss

|

$ | (1,194 | ) | |||||||||

|

BALANCES,

December 31, 2006

|

— | 85,716 | — | |||||||||

|

Exercise

of stock options

|

— | 1,438 | — | |||||||||

|

Issuance

of restricted shares, net of amortization

|

— | 444 | — | |||||||||

|

Net

income.

|

— | 117 | 117 | |||||||||

|

Increase

in unrealized gain on marketable securities

|

— | 4 | 4 | |||||||||

|

Total

comprehensive loss

|

$ | 121 | ||||||||||

|

BALANCES,

December 31, 2007

|

— | 87,719 | — | |||||||||

|

Exercise

of stock options

|

— | — | — | |||||||||

|

Equity

compensation

|

— | 677 | — | |||||||||

|

Net

loss.

|

— | (2,402 | ) | (2,402 | ) | |||||||

|

Increase

in unrealized gain on marketable securities

|

— | 390 | 390 | |||||||||

|

Total

comprehensive loss

|

$ | (2,012 | ) | |||||||||

|

BALANCES,

December 31, 2008

|

$ | — | $ | 86,384 | ||||||||

|

2008

|

2007

|

2006

|

||||||||||

|

OPERATING

ACTIVITIES:

|

||||||||||||

|

Net

(loss) income

|

$ | (2,402 | ) | $ | 117 | $ | (1,291 | ) | ||||

|

Adjustments

to reconcile net (loss) income to net cash used in operating

activities:

|

||||||||||||

|

Depreciation

of property and equipment

|

356 | 359 | 346 | |||||||||

|

Amortization

of (discount) and premium on securities, net

|

(1,945 | ) | (2,929 | ) | (2,405 | ) | ||||||

|

Equity

compensation

|

677 | 444 | 301 | |||||||||

|

Changes

in operating assets and liabilities:

|

||||||||||||

|

Decrease/(increase)

in interest receivable, prepaids and other current assets

|

57 | 419 | (154 | ) | ||||||||

|

Decrease

in deposits and other long-term assets

|

— | — | 956 | |||||||||

|

Decrease

in accounts payable and accrued liabilities

|

(235 | ) | (62 | ) | (781 | ) | ||||||

|

Increase

in deferred rent

|

67 | 66 | 69 | |||||||||

|

Net

cash used in operating activities

|

(3,425 | ) | (1,586 | ) | (2,959 | ) | ||||||

|

INVESTING

ACTIVITIES:

|

||||||||||||

|

Purchase

of marketable securities

|

(110,105 | ) | (150,803 | ) | (161,004 | ) | ||||||

|

Proceeds

from the sale and maturity of marketable securities

|

90,993 | 191,147 | 142,473 | |||||||||

|

Purchase

of property and equipment

|

(7 | ) | (48 | ) | (49 | ) | ||||||

|

Disposal

of property and equipment

|

— | 7 | — | |||||||||

|

Net

cash (used in) provided by investing activities

|

(19,119 | ) | 40,303 | (18,580 | ) | |||||||

|

FINANCING

ACTIVITIES:

|

||||||||||||

|

Proceeds

from the exercise of stock options

|

— | 1,438 | — | |||||||||

|

Net

cash provided by financing activities

|

— | 1,438 | — | |||||||||

|

CHANGE

IN CASH AND CASH EQUIVALENTS

|

(22,544 | ) | 40,155 | (21,539 | ) | |||||||

|

CASH

AND CASH EQUIVALENTS, beginning of year

|

41,886 | 1,731 | 23,270 | |||||||||

|

CASH

AND CASH EQUIVALENTS, end of year

|

$ | 19,342 | $ | 41,886 | $ | 1,731 | ||||||

|

SUPPLEMENTAL

DISCLOSURE:

|

||||||||||||

|

Decrease

in transaction expenses included in accounts payable and accrued

liabilities .

|

$ | — | $ | — | $ | (778 | ) | |||||

|

Decrease

in transaction expenses included in other assets

|

$ | — | $ | — | $ | (913 | ) | |||||

|

Cash

paid for franchise and property taxes

|

$ | 458 | $ | 456 | $ | 540 | ||||||

|

Level

1 -

|

Quoted

prices identical instruments in active markets

|

|

Level

2 -

|

Quoted

prices for similar instruments in active markets; quoted prices for

identical or similar instruments in markets that are not active; and

model-derived valuations whose inputs are observable or whose significant

value drivers are observable.

|

|

Level

3 -

|

Significant

inputs to the valuation model are

unobservable.

|

|

December 31,

|

Useful Life

|

|||||||||||

|

2008

|

2007

|

(in years)

|

||||||||||

|

Computers

and equipment

|

$ | 265 | $ | 263 | 1 - 5 | |||||||

|

Furniture

and fixtures

|

488 | 488 | 7 | |||||||||

|

Leasehold

improvements

|

1,893 | 1,893 | 8 | |||||||||

| 2,646 | 2,644 | |||||||||||

|

Less:

accumulated depreciation

|

(1,614 | ) | (1,263 | ) | ||||||||

|

Property

and equipment, net

|

$ | 1,032 | $ | 1,381 | ||||||||

|

2008

|

2007

|

|||||||

|

Accounts

payable

|

$ | 20 | $ | 17 | ||||

|

Accrued

bonuses

|

125 | 220 | ||||||

|

Accrued

professional services

|

156 | 205 | ||||||

|

Accrued

taxes

|

69 | 120 | ||||||

|

Other

|

13 | 56 | ||||||

| $ | 383 | $ | 618 | |||||

|

Options Vesting Period

|

1 year

|

|||

|

Dividend

Yield

|

0.00 | % | ||

|

Expected

volatility

|

28.95 | % | ||

|

Risk-free

interest rate

|

2.98 | % | ||

|

Expected

life

|

5.31 years

|

|||

|

Weighted

average fair value

|

$ | 1.61 | ||

|

Options Vesting Period

|

1 year

|

4 years

|

||||||

|

Dividend

Yield

|

0.00 | % | 0.00 | % | ||||

|

Expected

volatility

|

31.8 | % | 40.9 | % | ||||

|

Risk-free

interest rate

|

3.54 | % | 3.80 | % | ||||

|

Expected

life

|

5.75 years

|

6.25 years

|

||||||

|

Weighted

average fair value

|

$ | 2.22 | $ | 2.77 | ||||

|

2008

|

2007

|

2006

|

||||||||||

|

Weighted

average common shares – basic

|

16,867 | 16,658 | 16,613 | |||||||||

|

Effect

of dilutive stock options

|

— | 148 | — | |||||||||

|

Effect

of dilutive restricted stock

|

— | 245 | — | |||||||||

|

Total

effect of potential incremental shares

|

— | 393 | — | |||||||||

|

Weighted

average common shares – diluted

|

16,867 | 17,051 | 16,613 | |||||||||

|

Net

income (loss) per share:

|

||||||||||||

|

Basic

|

$ | (0.14 | ) | $ | 0.01 | $ | (0.08 | ) | ||||

|

Diluted

|

$ | (0.14 | ) | $ | 0.01 | $ | (0.08 | ) | ||||

|

YEARS

ENDED

|

||||||||||||

|

DECEMBER 31,

|

||||||||||||

|

2008

|

2007

|

2006

|

||||||||||

|

Pre-Tax

Income (loss):

|

||||||||||||

|

Domestic

|

$ | (2,402 | ) | $ | 120 | $ | (1,291 | ) | ||||

|

Foreign

|

— | — | — | |||||||||

| $ | (2,402 | ) | $ | 120 | $ | (1,291 | ) | |||||

|

YEARS

ENDED

|

||||||||||||

|

DECEMBER 31,

|

||||||||||||

|

2008

|

2007

|

2006

|

||||||||||

|

Current:

|

||||||||||||

|

Federal

|

$ | — | $ | 3 | $ | — | ||||||

|

State

|

— | — | — | |||||||||

|

Foreign

|

— | — | — | |||||||||

|

Total

current income for provision

|

$ | — | $ | 3 | $ | — | ||||||

|

YEARS ENDED

|

||||||||||||

|

DECEMBER 31,

|

||||||||||||

|

2008

|

2007

|

2006

|

||||||||||

|

Deferred:

|

||||||||||||

|

Federal

|

(273 | ) | 3,850 | (168 | ) | |||||||

|

State

|

16 | 1,218 | 350 | |||||||||

|

Foreign

|

— | — | — | |||||||||

| (256 | ) | 5,068 | 182 | |||||||||

|

Increase

(decrease) in valuation allowance for deferred income

taxes

|

256 | (5,068 | ) | (182 | ) | |||||||

|

Total

deferred income tax for provision

|

— | — | — | |||||||||

|

Total

income tax provision

|

$ | — | $ | 3 | $ | — | ||||||

|

2008

|

2007

|

2006

|

||||||||||

|

Income

(loss) from operations

|

$ | 256 | $ | (5,068 | ) | $ | (182 | ) | ||||

|

Stockholders’

equity

|

(152 | ) | (1 | ) | (38 | ) | ||||||

|

Total

|

$ | 104 | $ | (5,069 | ) | $ | (220 | ) | ||||

|

YEARS ENDED

DECEMBER 31,

|

||||||||||||

|

2008

|

2007

|

2006

|

||||||||||

|

Computed

"expected" income tax expense (benefit)

|

(34.0 | )% | 34.0 | % | (34.0 | )% | ||||||

|

Increase

(decrease) in income taxes resulting from: State income taxes, net of

federal income taxes

|

(1.6 | ) | 514.4 | (0.5 | ) | |||||||

|

NOL

adjustments

|

2.1 | 152.3 | 18.3 | |||||||||

|

Capital

loss carryforward adjustment

|

22.7 | 3,506.2 | 30.3 | |||||||||

|

Non-cash

stock compensation

|

— | (9.5 | ) | — | ||||||||

|

Other

|

0.2 | 8.2 | — | |||||||||

|

(Decrease)

increase in valuation allowance and other items

|

10.6 | (4,202.8 | ) | (14.1 | ) | |||||||

|

Income

tax expense (benefit)

|

— | % | 2.8 | % | — | % | ||||||

|

YEARS ENDED

DECEMBER 31,

|

||||||||

|

2008

|

2007

|

|||||||

|

Deferred

income tax assets (liabilities):

|

||||||||

|

Net

operating loss, capital loss amount and research &

experimentation credit carryforwards |

$ | 84,830 | $ | 84,970 | ||||

|

Charitable

contribution carryforward

|

5 | 4 | ||||||

|

Depreciation

|

(33 | ) | (139 | ) | ||||

|

Unrealized

gain on marketable securities

|

(157 | ) | (5 | ) | ||||

|

Non-cash

compensation

|

988 | 724 | ||||||

|

Accrued

liabilities

|

159 | 134 | ||||||

|

Reserves

for investments

|

1,728 | 1,728 | ||||||

|

Net

deferred income tax assets before valuation allowance

|

87,520 | 87,416 | ||||||

|

Valuation

allowance for deferred income tax assets

|

(87,520 | ) | (87,416 | ) | ||||

|

Net

deferred income tax assets

|

$ | — | $ | — | ||||

|

Net Operating

Loss

|

||||

|

Expiration Dates

December 31

|

Amount

(000’s)

|

|||

|

2009

|

$ | 1,900 | ||

|

2010

|

7,417 | |||

|

2011

|

7,520 | |||

|

2012

|

5,157 | |||

|

2020

|

29,533 | |||

|

2021

|

50,430 | |||

|

2022

|

115,000 | |||

|

2023

|

5,712 | |||

|

2024

|

3,566 | |||

|

2025

|

1,707 | |||

|

2026

|

476 | |||

|

2028

|

1,372 | |||

|

Total

|

229,790 | |||

|

Section 382 limitation

|

(4,428 | ) | ||

|

After

Limitations

|

$ | 225,362 | ||

|

Options Vesting Period

|

1 year

|

|||

|

Dividend

Yield

|

0.00 | % | ||

|

Expected

volatility

|

28.95 | % | ||

|

Risk-free

interest rate

|

2.98 | % | ||

|

Expected

life

|

5.31

years

|

|||

|

Weighted

average fair value

|

$ | 1.61 | ||

|

Options Vesting Period

|

1 year

|

4 years

|

||||||

|

Dividend

Yield

|

0.00 | % | 0.00 | % | ||||

|

Expected

volatility

|

31.8 | % | 40.9 | % | ||||

|

Risk-free

interest rate

|

3.54 | % | 3.80 | % | ||||

|

Expected

life

|

5.75

years

|

6.25

years

|

||||||

|

Weighted

average fair value

|

$ | 2.22 | $ | 2.77 | ||||

|

Shares

|

Range of

Exercise

Prices

|

Weighted

Average

Exercise

Price

|

||||||||||

|

December

31, 2005

|

1,681,250 | $5.35-$10.00 | $ | 7.36 | ||||||||

|

Granted

|

— | |||||||||||

|

Forfeited

|

— | |||||||||||

|

Expired

|

(7,500 | ) | $5.41 | $ | 5.41 | |||||||

|

Exercised

|

— | |||||||||||

|

December

31, 2006

|

1,673,750 | $5.35-$10.00 | $ | 7.36 | ||||||||

|

Granted

|

430,000 | $5.98 | $ | 5.98 | ||||||||

|

Forfeited

|

(7,757 | ) | $7.40-$8.60 | $ | 8.17 | |||||||

|

Expired

|

— | |||||||||||

|

Exercised

|

(247,243 | ) | $5.35-$8.60 | $ | 5.81 | |||||||

|

December

31, 2007

|

1,848,750 | $5.35-$10.00 | $ | 7.24 | ||||||||

|

Granted

|

60,000 | $5.01 | $ | 5.01 | ||||||||

|

Forfeited

|

— | |||||||||||

|

Expired

|

— | |||||||||||

|

Exercised

|

— | |||||||||||

|

December

31, 2008

|

1,908,750 | $5.01-$10.00 | $ | 7.17 | ||||||||

|

Vested

and exercisable at December 31, 2008

|

1,668,750 | $ | 7.36 | |||||||||

|

Vested

and exercisable at December 31, 2007

|

1,493,750 | $ | 7.54 | |||||||||

|

Vested

and exercisable at December 31, 2006

|

1,673,750 | $ | 7.36 | |||||||||

|

Outstanding

|

Exercisable

|

|||||||||||||||||||

|

Exercise

Price

Range

|

Number

of Shares

Outstanding at

December 31, 2008

|

Weighted

Average

Exercise

Price

|

Weighted

Average

Remaining

Contractual

Life (Years)

|

Number

of Shares

Exercisable at

December 31, 2008

|

Weighted

Average

Exercise

Price

|

|||||||||||||||

|

$

5.01 - $ 5.52

|

450,000 | $ | 4.97 | 6.0 | 420,000 | $ | 5.33 | |||||||||||||

|

$

5.53 - $10.00

|

1,458,750 | $ | 6.89 | 6.6 | 1,248,750 | $ | 8.04 | |||||||||||||

| 1,908,750 | $ | 7.17 | 6.4 | 1,668,750 | $ | 7.36 | ||||||||||||||

|

Gross Rental

|

Sub-Lease

|

|||||||

|

Obligations

|

Income

|

|||||||

|

Year

ending December 31,

|

||||||||

|

2009

|

426 | 106 | ||||||

|

2010

|

451 | 113 | ||||||

|

2011

|

1,128 | 282 | ||||||

|

2012

|

— | — | ||||||

|

2013

|

— | — | ||||||

|

Thereafter

|

— | — | ||||||

|

Total

|

$ | 2,005 | $ | 501 | ||||

|

Page

|

||

|

Report

of Independent Registered Public Accounting Firm on Consolidated Financial

Statements and Internal Control over Financial Reporting

|

24

|

|

|

Consolidated

Balance Sheets - December 31, 2008 and 2007

|

25

|

|

|

Consolidated

Statements of Operations -Years Ended December 31, 2008, 2007 and

2006

|

26

|

|

|

Consolidated

Statements of Stockholders' Equity and Comprehensive Loss -Years Ended

December 31, 2008, 2007 and 2006

|

27

|

|

|

Consolidated

Statements of Cash Flows -Years Ended December 31, 2008, 2007 and

2006

|

29

|

|

|

Notes

to Consolidated Financial Statements

|

30

|

|

|

|

||

|

(2)

The following additional financial statement schedule and report of

independent registered public accounting firm are furnished herewith

pursuant to the requirements of Form 10-K:

|

||

|

Schedule

II Valuation and Qualifying Accounts

|

51

|

|

Exhibit

Number

|

Exhibit

|

|

|

3.1

|

Amended

and Restated Certificate of Incorporation of the Company (incorporated

herein by reference to Exhibit 3.3 of the Company's Form S-1/A

Registration Statement filed with the Securities and Exchange Commission

on April 6, 1998 (File No. 333- 46685)).

|

|

|

3.2

|

Amendment

to Amended and Restated Certificate of Incorporation (incorporated herein

by reference to Exhibit 4.1 of the Company's 10-Q filed with

the Securities and Exchange Commission on August 14,

2000).

|

|

|

3.3

|

Amended

and Restated Certificate of Incorporation of the Company (incorporated

herein by reference to Appendix C of the Company’s Definitive Proxy

Statement filed with the Securities and Exchange Commission on November 6,

2002).

|

|

|

3.4

|

Amendment

to Amended and Restated Certificate of Incorporation of the Company

(incorporated herein by reference to Exhibit 3.1 of the

Company's Current Report on Form 8-K, filed with the Securities and

Exchange Commission on July 31, 2003).

|

|

|

3.5

|

Amended

and Restated Bylaws of the Company (incorporated herein by reference to

Appendix D of the Company's Definitive Proxy Statement filed with the

Securities and Exchange Commission on November 6,

2002).

|

|

|

3.6

|

Amendment

No. 1 to the Amended and Restated Bylaws of the Company. (incorporated

herein by reference to Exhibit 3.4 of the Company's Annual

Report on Form 10-K, filed with the Securities and Exchange Commission on

March 31, 2003).

|

|

|

3.7

|

Form

of Certificate of Designation of Series A Junior Participating Preferred

Stock (incorporated herein by reference to Exhibit 3.1 of the Company's

Form 8-K, filed with the Securities and Exchange Commission on February

13, 2008).

|

|

|

4.1

|

See

Exhibits 3.1, 3.2, 3.3, 3.4 and 3.5 for provisions of the Amended and

Restated Certificate of Incorporation and Amended and Restated

Bylaws of the Company defining rights of the holders of Common Stock of

the Company.

|

|

|

4.2

|

Specimen

Stock Certificate (incorporated herein by reference to Exhibit 4.2 of the

Company's Registration Statement on Form S-1 filed with the

Securities and Exchange Commission on May 26, 1998 (File No.

333-46685)).

|

|

4.3

|

Restricted

Stock Agreement, dated as of April 11, 2003, between the Company and

Warren B. Kanders (incorporated herein by reference to Exhibit

4.1 of the Company's Form 10-Q filed with the Securities and Exchange

Commission on May 15, 2003). *

|

|

|

4.4

|

Rights

Agreement, dated as of February 12, 2008, by and between Clarus

Corporation and American Stock Transfer & Trust Company (incorporated

herein by reference to Exhibit 4.2 of the Company’s Form 8-K filed with

the Securities and Exchange Commission on February 13,

2008).

|

|

|

4.5

|

Form

of Rights Certificate (incorporated herein by reference to Exhibit 4.1 of

the Company’s Form 8-K filed with the Securities and Exchange Commission

on February 13, 2008).

|

|

|

10.7

|

Form

of Indemnification Agreement for Directors and Executive Officers of the

Company (incorporated herein by reference to Exhibit 10.1 of

the Company's Form 8-K filed with the Securities and Exchange Commission

on December 23, 2002).

|

|

|

10.8

|

Employment

Agreement, dated as of December 6, 2002, between the Company and Warren B.

Kanders (incorporated herein by reference to Exhibit 10.2 of

the Company's Form 8-K filed with the Securities and Exchange Commission

on December 23, 2002).*

|

|

|

10.9

|

Amended

and Restated Stock Incentive Plan (incorporated herein by reference to

Exhibit 10.2 of the Company's Form 10-Q filed with the

Securities and Exchange Commission on August 14, 2000).

*

|

|

|

10.10

|

Form

of Nonqualified Stock Option Agreement (incorporated herein by reference

to Exhibit 10.5 of the Company's Form 10- Q filed with the Securities and

Exchange Commission on August 14, 2000). *

|

|

|

10.11

|

Lease,

dated as of September 23, 2003, between Reckson Operating Partnership,

L.P., the Company and Kanders & Company, Inc. (incorporated herein by

reference to Exhibit 10.1 of the Company's 10-Q filed with the Securities

and Exchange Commission on November 12, 2003).

|

|

|

10.12

|

Transportation

Services Agreement, dated as of December 18, 2003, between Kanders

Aviation, LLC and the Company (incorporated herein by reference to Exhibit

10.23 of the Company's 10-K filed with the Securities and Exchange

Commission on March 11, 2004).

|

|

|

10.13

|

Clarus

Corporation 2005 Stock Incentive Plan (incorporated herein by reference to

Appendix A of the Company's Definitive Proxy Statement filed with the

Securities and Exchange Commission on May 2, 2005). *

|

|

|

10.14

|

Form

of Stock Option Agreement for the Clarus Corporation 2005 Stock Incentive

Plan (incorporated herein by reference to Exhibit 10.1 of the

Company's Form 10-Q filed with the Securities and Exchange Commission on

November 3, 2005). *

|

|

|

10.15

|

Amendment

to the form of Stock Option Agreement for the Clarus Corporation 2005

Stock Incentive Plan (incorporated herein by reference to

Exhibit 10.1 of the Company's Form 8-K filed with the Securities and

Exchange Commission on January 6, 2006). *

|

|

|

10.16

|

Stock

Option Agreement, dated December 23, 2002, between the Company and Warren

B. Kanders (incorporated herein by reference to Exhibit 4.6 of the

Company's Registration Statement Form S-8 filed with the Securities and

Exchange Commission on August 18, 2005). *

|

|

|

10.17

|

Extension

Agreement, dated as of May 1, 2006, to the Employment Agreement, dated as

of December 6, 2002, between the Company and Warren B. Kanders

(incorporated herein by reference to Exhibit 10.2 of the Company’s Form

8-K filed with the Securities and Exchange Commission on May 4,

2006).*

|

|

|

10.18

|

Resignation

and Severance Agreement and General Release, dated as of December 11,

2006, between the Company and Nigel P. Ekern (incorporated herein by

reference to Exhibit 10.1 of the Company’s Form 8-K filed with the

Securities and Exchange Commission on December 12,

2006).*

|

|

|

23.1

|

Consent

of Independent Registered Public Accounting Firm.**

|

|

|

31.1

|

Certification

of Principal Executive Officer, as required by Rule 13a-14(a) of the

Securities Exchange Act of 1934.**

|

|

|

31.2

|

Certification

of Principal Financial Officer, as required by Rule 13a-14(a) of the

Securities Exchange Act of

1934.**

|

|

32.1

|

Certification

of Principal Executive Officer, as required by Rule 13a-14(b) of the

Securities Exchange Act of 1934.**

|

|

|

32.2

|

Certification

of Principal Financial Officer, as required by Rule 13a-14(b) of the

Securities Exchange Act of

1934.**

|

|

|

*

|

Management

contract or compensatory plan or

arrangement.

|

|

|

**

|

Filed

herewith

|

|

Date: March

3, 2009

|

|||

|

By:

|

/s/ Philip A. Baratelli

|

||

| Philip A. Baratelli | |||

| Chief Financial Officer | |||

|

Signature

|

Title

|

Date

|

||

|

/s/ Warren B. Kanders

|

Executive

Chairman of the

|

March 3,

2009

|

||

|

Warren

B. Kanders

|

Board

of Directors

|

|||

|

(principal

executive officer)

|

||||

|

/s/ Philip A. Baratelli

|

Chief

Financial Officer

|

March 3,

2009

|

||

|

Philip

A. Baratelli

|

(principal

financial officer)

|

|||

|

/s/ Donald L. House

|

Director

|

March 3,

2009

|

||

|

Donald

L. House

|

||||

|

/s/ Burtt R. Ehrlich

|

Director

|

March 3,

2009

|

||

|

Burtt

R. Ehrlich

|

||||

|

/s/ Nicholas Sokolow

|

Director

|

March 3,

2009

|

||

|

Nicholas

Sokolow

|

|

/s/ KPMG LLP

|

|

Stamford,

Connecticut

|

|

March 3,

2009

|

|

Balance at

Beginning of

Period

|

Charged

(Credited) to

Costs and

Expenses

|

Deductions (a) (b)

|

Balance at

End of

Period

|

|||||||||||||

|

Valuation

Allowance for Deferred Income Tax Assets

|

||||||||||||||||

|

2006

|

$ | 92,705,000 | $ | (220,000 | ) | $ | — | $ | 92,485,000 | |||||||

|

2007

|

92,485,000 | (5,069,000 | ) | — | 87,416,000 | |||||||||||

|

2008

|

$ | 87,416,000 | $ | 256,000 | $ | (152,000 | ) | $ | 87,520,000 | |||||||

|

Restructuring

Accruals

|

||||||||||||||||

|

2006

|

$ | 17,000 | — | $ | (17,000 | ) | — | |||||||||

|

(a)

|

Deductions

related to restructuring and related accruals represent cash

payments.

|

|

(b)

|

Deduction

related to valuation allowance for deferred income tax assets represents

decrease in valuation allowance credited to stockholders’

equity.

|

|

Number

|

Exhibit

|

|

|

23.1

|

Consent

of Independent Registered Public Accounting Firm.

|

|

|

31.1

|

Certification

of Principal Executive Officer, as required by Rule 13a-14(a) of the

Securities Exchange Act of 1934.

|

|

|

31.2

|

Certification

of Principal Financial Officer, as required by Rule 13a-14(a) of the

Securities Exchange Act of 1934.

|

|

|

32.1

|

Certification

of Principal Executive Officer, as required by Rule 13a-14(b) of the

Securities Exchange Act of 1934.

|

|

|

32.2

|

Certification

of Principal Financial Officer, as required by Rule 13a-14(b) of the

Securities Exchange Act of

1934

|